Toby Hill talks with industry experts and insiders to get the latest tips on how wholesalers can maximise sales on the ever-shifting terrain of the tobacco & vaping category

The latest tidal wave to hit the traditional tobacco industry struck in May, with the menthol ban taking effect.

The move is expected to accelerate pre-existing trends within the tobacco category, as adult smokers switch to vapes, while roll-your-own (RYO) tobacco continues to consume a growing slice of the market.

The move is expected to accelerate pre-existing trends within the tobacco category, as adult smokers switch to vapes, while roll-your-own (RYO) tobacco continues to consume a growing slice of the market.

Vape sales grew by 24.3% in traditional retail over the past year, according to IRI statistics. Overall, the UK market is expected to grow from £1.1bn to £1.7bn in value by 2025. Clearly, it’s vital for wholesalers to learn how to surf the vaping wave. Even with these shifts, however, cigarettes remain the biggest individual segment in the category, so wholesalers can’t afford to neglect the traditional lines, either.

Vape variety

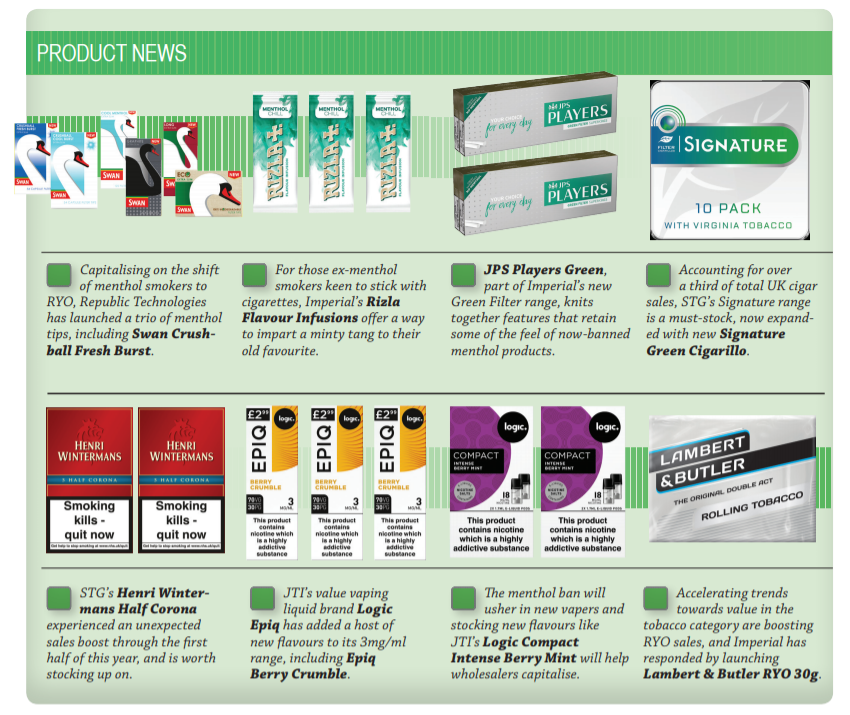

The menthol ban has struck down flavours in cigarettes, but in vaping it has fuelled further proliferation. Indeed, manufacturers have been quick to develop products targeting menthol smokers, as they weigh up their options between moving to RYO or vapes.

Last month, just before the ban took effect, JTI launched two menthol flavour pods as part of its Logic Compact Intense range: Berry Mint and Polar Menthol. “Retailers should look to offer a wide range of post-ban menthol alternatives to cater for their customers’ needs,” advises Nick Geens, head of reduced-risk products at JTI.

JTI has made similar additions to its Logic Epiq range – its economy vaping brand – in this case, adding nicotine salts and 70/30 e-liquids to an already extensive offering.

Logic Epiq nicotine salts is said to offer an intense flavour boost and is available in a wide range of flavours, including Amber Tobacco, Peppermint, Berry Mint and Forest Fruits.

The 70/30 e-liquid range, meanwhile, includes flavours such as Coconut Macaroon, Mint Royale, Berry Crumble and Cherry Apple.

Clearly, for smokers who like a bit of flavour, the menthol ban has only catalysed a broadening of their options – as long as they’re willing to switch to vaping.

Catching up

However, while the menthol ban opens a door to many new opportunities in the vaping category, the wholesaler sector has some catching up to do if it is to take full advantage of them.

Despite such strong category growth, the channel was slow to build links with suppliers, leaving many manufacturers to target retailers directly.

With these supply lines established, wholesalers will have to be proactive if they’re to get a slice of this rapidly expanding pie. “The downward trend on tobacco is going to continue, so there will be a growing vape market, which should make it easier for wholesalers to take some share, says Dee Bee Wholesale trading director Andy Morrison. “But it is certainly challenging with the direct-to market competition, as well as the plethora of formats available.”

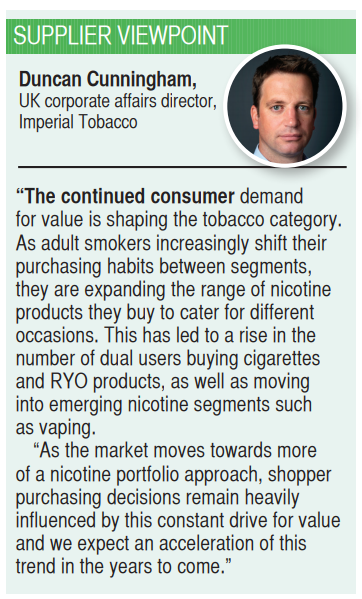

Wholesalers will need to readjust depot layouts and experiment with different products among the array of possible options, adds Duncan Cunningham, UK corporate affairs director at Imperial Tobacco.

“We’d recommend stocking as broad a range as space allows and then fine-tuning this in the weeks and months that follow according to customer feedback and sales. The wholesalers that can remain agile will be in the best position to cater for their customers and grow their nicotine sales as a result,” he says.

One simple place to start is with pod-mod systems like Myblu, Cunningham suggests, which have become increasingly popular thanks to their ease of use and flexibility. Its liquidpod system enables consumers to switch between multiple flavours in seconds via a one-step ‘click and go’ framework.

“Myblu now has an Intense Starter Kit that features the pod-mod vape device and USB charger, along with two Intense Liquidpods,” Cunningham adds.

Recent flavour innovations aim to balance demand for menthol and fruit: Blue Ice has hints of blueberry, Strawberry Mint brings two perennial favourites together, while Eucalyptus Lemon combines sour lemon with the cool mint tones of eucalyptus.

Going traditional

Even while the tobacco category undergoes a fundamental reshaping, however, cigarettes remain the overall biggest seller, accounting for approximately 60% of volume sales.

In this context, it’s value that continues to shape purchasing decisions, a trend that’s accelerated since first kicking into gear following plain packaging legislation.

“Over the past few years we’ve repositioned a number of our products to help wholesalers and retailers cater for this downtrading trend,” says Cunningham at Imperial. This has involved moving L&B Blue into the sub-economy sector and, more recently, repositioning Embassy from the premium price sector to the more popular economy sector.

Manufacturers have also been innovating to develop products that can retain some of the features that smokers appreciated about menthol cigarettes.

Imperial’s new Green Filter range – launching across five of the firm’s leading brands – includes a white-tipped firm filter and Reduced Smoke Smell paper. They can be coupled with the firm’s Rizla Flavour Infusions – flavoured paper that can be slipped into cigarette packs.

Similarly, the RYO sector is continuing to grow, boosted by both trends towards value and the fact consumers are still able to buy menthol filters.

Imperial is seeking to capitalise on this with the launch of its new Lambert & Butler RYO blend, launched with an RRP of £11 for 30g and £18.15 for 50g.

All these trends are good news for the tobacco accessories market, too. Republic Technologies recently launched three new menthol filters to its range of Swan products: Crushball Fresh Burst, Crushball Cool Burst and Cool Menthol – each offering a point of difference in the market.

Unusual developments

Finally, while the cigar sub-category is being shaped by similar trends as its neighbouring products, recent months have witnessed some unexpected developments, as Scandinavian Tobacco Group country director Alastair Williams explains.

“While most of the usual key cigar trends such as ‘value for money’ have remained, we’ve seen some interesting new ones, too. Probably because people have been at home more, coupled with some nice weather recently, we’ve seen sales of our larger format cigars being particularly positive. In fact, sales from our warehouse of our Henri Wintermans Half Corona were up 20% in April,” he says.

With plenty of new opportunities still out there and the category consistently evolving, wholesalers need to remain alert for any new developments that could potentially lead to a tidy profit.