Toby Hill casts his eye over the challenges and opportunities that face this category when the menthol ban kicks in

While it’s come to be known as the ‘menthol ban’, the legislative changes rolling into place on 20 May are, in fact, significantly broader. From that date, any cigarette or roll-your-own (RYO) tobacco containing characterising flavours will be banned from sale.

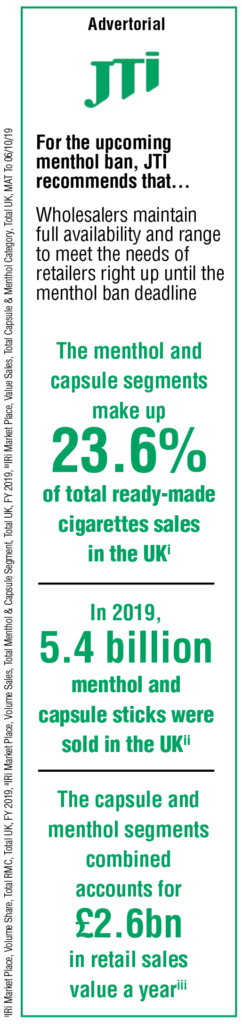

With menthol and crushball sales making up 26% of the total UK tobacco market, this is a huge disruption. As Simon Clark, director of tobacco campaign group Forest, puts it: “In May, more than one million smokers will walk into their local store and find that a product they’ve been buying for years – if not decades – is no longer available.”

Wholesalers, then, need to be prepared. Here we take a look at how they can respond to the change, harnessing current market trends to ensure disappointed customers find alternatives that suit them.

Victory for vaping

Most obviously, the ban could direct a wave of smokers towards the vaping market, where they’ll still be able to enjoy a flavoured nicotine hit.

“We fully expect the ban on menthol cigarettes to provide a real opportunity for wholesalers to take advantage of potentially increased sales in menthol and other flavoured e-liquids and e-cigarettes,” says John Taylor, chief marketing officer at Vape Dinner Lady.

Indeed, regardless of the menthol ban, wholesalers should be watching the vaping category with interest. The latest figures from ASH show that the number of vapers in the UK rose to 3.6 million in 2019, up 12.5 % from 2018. This means the UK market is expected to grow from £1.1bn to £1.7bn in value by 2025.

The impact of the ban opens a particular opportunity to catch former menthol smokers with a strong offering of menthol flavours. NextGen360’s Edge range, for example, offers flavours including Menthol, Very Menthol and Cherry Menthol, each in a variety of strengths.

In terms of vaping devices themselves, convenience retailers are likely looking for simpler products that require less specialisation, making pod vape systems a popular choice. These two-part systems involve a pod filled with vape juice – which can be pre-filled or refillable – that snaps into a small battery.

“Pod vapes are more popular than ever, so wholesalers should consider stocking devices such as Logic Compact, which offer a convenient and modern alternative to traditional vaping products,” says Nick Geens, head of reduced-risk products at JTI UK.

“What’s more, with vapers becoming more experimental, it is also important to stock a wide range of flavours to suit different tastes.”

A sub-category that has seen a recent explosion in popularity are pod-mods, such as Imperial tobacco’s Myblu system. Easy to use, flexible and small, these convenient products are great for non-specialist retailers.

Alternatively, some former smokers wondering where to go once the menthol ban hits are likely to prefer an even simpler alternative.

In line with this, manufacturer Vape Dinner Lady – which recently burst onto the e-liquids scene with its Lemon Tart flavour – offers disposable e-cigarettes, including the Dinner Lady Disposable E-Cigarette in Blue Menthol.

Craving good value

Back in the conventional tobacco market, the latest legislative hammer blow is likely to accelerate two recent trends. Firstly, the shift towards economy products will almost certainly intensify.

Secondly, the upheaval in the market will continue to see adult smokers become more flexible in their purchasing habits, buying different nicotine products to cater for different occasions.

“As consumers move towards more of a nicotine portfolio approach, shopper purchasing decisions remain heavily influenced by this constant drive for value and we expect an acceleration of this trend in the years to come,” says Duncan Cunningham, UK corporate affairs director at Imperial Tobacco.

Over the past few years, Imperial has repositioned a number of its factory-made cigarette (FMC) products to reflect this downtrading trend, shifting L&B Blue into the sub-economy sector, and moving Embassy from premium to the more popular economy sector.

The demand for value has also boosted sales of RYO products, which now account for 45% of fine-cut tobacco sales, up from 38% on the previous year.

In line with this growth, Imperial expanded its Riverstone range last year, which has become one of the fastest- growing tobacco brands on the market since its 2018 launch, tapping into the demand for easy-to-roll tobacco at an affordable price.

Competitor JTI has also stepped up its focus on the RYO market. The manufacturer’s Amber Leaf brand is the UK’s biggest RYO seller, accounting for 30% of market share. Its value alternative, Sterling, is currently the UK’s fastest-growing tobacco brand.

Retailer viewpoints on the menthol ban

“We’re informing people about the ban and many say, ‘Oh I’ll give up, then,’ although they said the same before previous changes. In reality, our tobacco sales are very buoyant, although about a quarter come from the dual cigarettes, so it will be interesting to see what those shoppers will do – I’ve no idea yet. We’ve got some vaping products and I suspect we’ll have to step them up.”

Bob Sykes, Denmore Premier, Rhyl

“It’s hard to know how to prepare for the ban. We’re seeing people looking to move to vape and we do have an offering. But there’s a lot we don’t stock, as it’s just too technical if you don’t have trained staff. Otherwise, the main question we hear when people are buying conventional tobacco is, ‘What’s your cheapest?’”

Martin Ward, Cowpen Lane News, Stockton-on-Tees

“The menthol ban is frustrating, as we’ve got a lot of customers. I’m looking for things you can slip into a packet of cigarettes that the tobacco will absorb and leave a hint of flavour. I’ve only seen one product, from Rizla. We also do vaping products, although they’ve been hit by the bad publicity.”

Hitesh Pandya, Toni’s News, Ramsgate, Kent

“We’re having a new gantry, which is more focused on e-liquids, and then there’s a heated tobacco device from Philip Morris, which we’ll promote. There’s no option left but to go down the alternatives route. It can be a puzzle with all the different products, but we just focus on a few.”

Harvinder Singh Thiara, Marty’s Convenience, Lifestyle Express, Birmingham

Advancing accessories

Trends towards RYO products have provided a boost to sales of tobacco accessories, now worth £290m, a 6% increase year on year. Filters in particular are growing quickly, up 9%.

“The combination of rising cigarette prices and the higher margins offered by RYO products will continue to drive growth,” says Gavin Anderson, general sales manager at Republic Technologies. “While the vaping sector continues to expand, it’s not inhibiting the sustained rise in demand for RYO accessories, and with menthol cigarettes being discontinued from May 2020, accessories may well provide the solutions and options that consumers will be seeking.”

Indeed, recent innovation within tobaccos accessories could provide a solution for menthol smokers facing the loss of their favourite lines when the menthol ban hits. One solution formulated by Imperial Tobacco is Rizla Flavour Infusion cards, which can be slipped into a pack of cigarettes to impart that familiar menthol flavour.

Sanguine cigars

While technological innovation and legislative change has transformed the cigarette market, key trends in the cigar category have remained fairly constant.

“First, there is the continued rise in miniature cigars, which now account for just over 74% of total sales, increasing by 5% in 2019 compared with the previous year,” says Alastair Williams, country director at Scandinavian Tobacco Group (STG). “Secondly, we have seen for a while now a consistent growth in adult smokers looking for good-quality value-for-money propositions.”

STG has taken care to align its range with these trends, Williams adds. Moments is an economy brand that is currently experiencing the fastest cigar sales growth in the UK.

In the miniatures sub-category, meanwhile, Signature – rebranded from Café Crème in 2018 – dominates the segment with two-thirds of sales. And the firm’s Henri Wintermans Half Corona line holds the position as the UK’s favourite medium-to-large cigar.

“If wholesalers combine our insights on the cigar category with their knowledge of their local customer base then they shouldn’t go far wrong,” Williams concludes.