Paul Hill looks at how the rise of ecommerce and phone applications has changed the technological landscape of the wholesale channel

Mobile app ecommerce technology is the fastest-growing sales channel in the sector, with new wholesalers continuing to embrace what it has to offer. Software business RNF Digital is one of the leaders in ecommerce and provides the framework and support to facilitate a move into the field. Its managing director, Rob Mannion, believes there has been a shift with the type of wholesalers using it.

“Many wholesalers have an ecommerce capability, but in the past two years, we have witnessed not only the retail-focused ones move into the mobile app ordering space, but the foodservice operators, too,” he says.

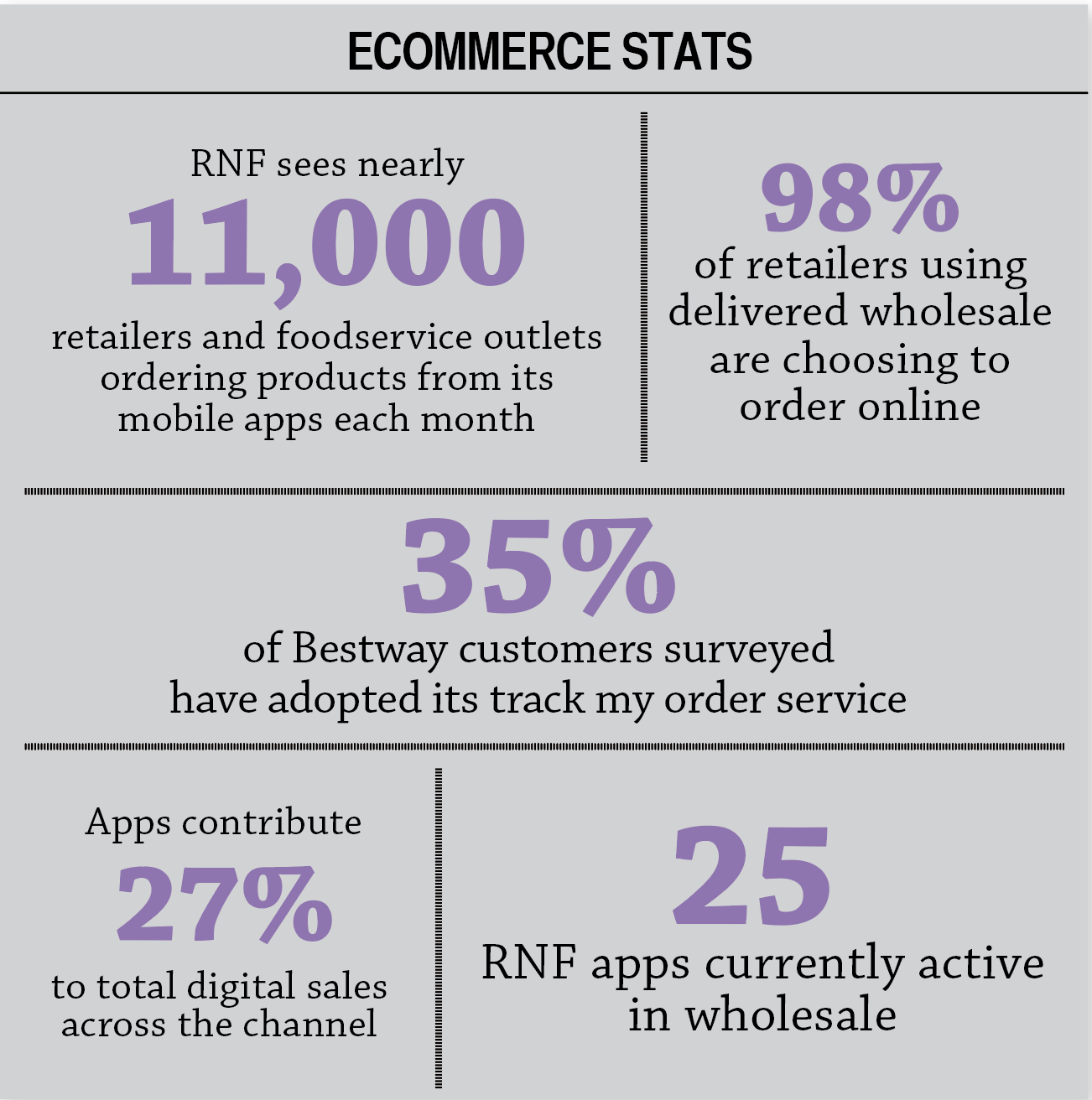

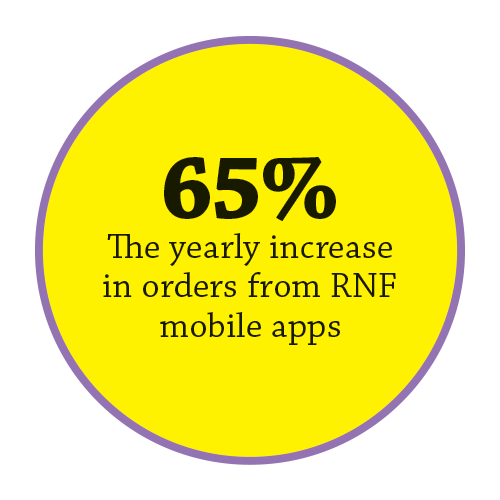

This is exemplified with the fact that RNF is now seeing nearly 11,000 retailers and foodservice outlets ordering products from its mobile apps each month – an increase of 65% year on year. “With more and more customers demanding click-and-collect or delivery, this clearly creates operational challenges back at the warehouse as the wholesaler strives to meet its obligations to fulfil the order. As such, we are now starting to see websites and apps incorporate live order status or tracking functionality,” adds Mannion.

This is exemplified with the fact that RNF is now seeing nearly 11,000 retailers and foodservice outlets ordering products from its mobile apps each month – an increase of 65% year on year. “With more and more customers demanding click-and-collect or delivery, this clearly creates operational challenges back at the warehouse as the wholesaler strives to meet its obligations to fulfil the order. As such, we are now starting to see websites and apps incorporate live order status or tracking functionality,” adds Mannion.

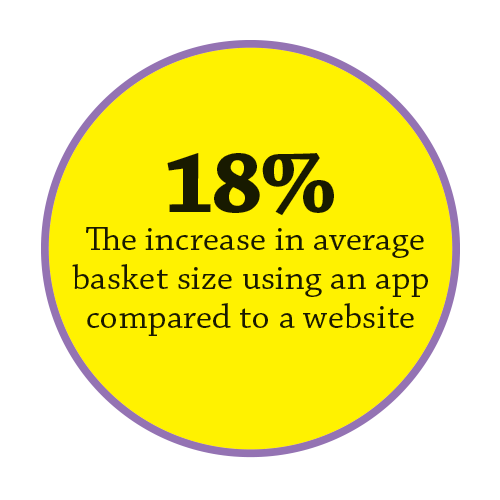

RNF’s data backs up the benefits. “It leads to significantly higher average baskets than in-depot purchases and, when we compare apps to websites specifically, there are 18% larger basket sizes.

“There are huge benefits to be realised by investing in your digital channel, or route to market. Specifically, with apps, your entire business offering is literally transferred to your customers’ smartphones, which they have on them 24/7,” he explains. “Customers then have the ability to order products at times entirely of their choosing and not only when they are in the cash and carry.”

Meanwhile, insight company HIM recently commissioned a report on the topic titled ‘Wholesale Online Report 2019’, which backs up RNF’s data that ordering through a phone app leads to an increase in basket sizes. The company’s communications manager, Giorgio Rigali, believes the industry is behind the curve. “In terms of digital capabilities, wholesale is playing catch-up with other industries. Wholesalers are starting to invest more into digital and are acknowledging how important it is to their business. However, they need the support of suppliers in order to maximise its potential,” he explains.

The report indicates that, according to industry feedback, apps represent 25-30% of total digital sales across the wholesale channel, with 98% of retailers who use delivered wholesale choosing to order online.

Meanwhile, FWD chief executive James Bielby highlights the revolutionary aspects of the platform. “Wholesalers need only to look at how consumers are adopting digital technologies to know that we have to be part of the revolution in how we influence purchasing decisions, collect consumer behaviour data and receive payments,” he says. “Retailers and foodservice operators are consumers, too, so will increasingly expect the same interfaces in their business transactions as they have in their personal ones.”

The current market

There are already a multitude of different platforms offering services to wholesalers. 443 AI has been developed by industry expert Jason Finch, and, once set up, can be tailored to the company’s individual needs, integrating with its resource planning, stock checking and pricing.

e.fundamentals is another ecommerce analytics platform that allows brands to monitor and optimise their online sales performance through the channel.

Both are already available for companies looking to embrace the technology.

Confex already has an app on the market that can be customised to its members’ business needs, while Bestway recently introduced a new ordering app and website. It allows customers to start their order on a phone, tablet or computer and finish it on another device, with the basket updated in real time. Also, since launching its ‘track my order’ service, Bestway managing director Dawood Pervez says 35% of the customers surveyed have adopted the service.

Confex already has an app on the market that can be customised to its members’ business needs, while Bestway recently introduced a new ordering app and website. It allows customers to start their order on a phone, tablet or computer and finish it on another device, with the basket updated in real time. Also, since launching its ‘track my order’ service, Bestway managing director Dawood Pervez says 35% of the customers surveyed have adopted the service.

“This is a logical next step in our digital pathway and the most important thing is that it offers great service,” he says. “But what does ‘service’ mean nowadays? It means having the product your customer wants and offering them a good ordering experience where they can navigate easily to what they need.”

JJ Foodservice is another leading pioneer of ecommerce within wholesale. In 2009, it became the first of its kind to launch an online ordering portal that enabled customers to order via its website for collection or delivery. Within a year, online orders accounted

for 30% of its sales.

Chief operating officer Mushtaque Ahmed explains that the website uses machine learning technology to predict basket items and make accurate, data-led recommendations on what customers are likely to purchase. “These functions account for an average of 20% of basket spend,” he says.

“Predictive ordering is also available via the JJ App, which has been downloaded more than 25,000 times.

“Today, online orders have increased to 60%, and it’s still growing.”

The company has also lent its technological expertise to support its customers, with its sister-business FOODit helping to build restaurant websites for caterers and aid them in SEO strategies. “In the first six weeks of 2019, total revenue for FOODit customers was 5.8% up on the same period last year,” Ahmed adds.

JW Filshill is another business witnessing growth in its online output, following a modernisation of its order process. “Our electronic order capture has moved from 45% to 69% in the past year,” explains retail sales director Craig Brown. “There will always be a need for the personal touch, but by minimising manual tasks it makes the business more efficient and should be embraced.”

Challenges

However, by embracing ecommerce and web applications, wholesalers do set themselves up for certain challenges, says Bielby. “Bedding in new systems requires

a huge investment of time and resource, and technology advances so quickly. In

the past, this may have been used as an excuse for not investing at all, but the further behind you fall, the harder it will be to catch up.”

Rigali echoes these thoughts, describing how there are no shortcuts if a company wishes to maximise the potential of digital platforms. He explains: “Wholesalers need to ensure they understand the needs of retailers and tailor their platforms to cater for them.

“Retailers are behaving differently to consumers, so mirroring a B2C strategy for B2B ecommerce simply won’t work.”

Industry expert David Gilroy says the world of technology is moving so fast, it makes it extremely challenging for a typical wholesaler to know what technology to actually invest in. “The decision a wholesaler might ask themselves is not what technology to invest in, but to consider which technology partner they should be aligning themselves to,” he says.

“Integrating websites or apps to the wholesalers back-end systems can also be daunting, especially as many enterprise resource planning suppliers are resistant to wholesalers introducing external services to their own.”

The future

But what does the future hold for the old-style methods of conducting business? According to Rigali, there certainly remains a future for non-technological methods of communication between wholesalers and retailers. “Printed brochures are still the main source for retailers to find out about NPD.

“Furthermore, we are actually seeing older methods of ordering, like barcode scanning, link up with newer ones. Barcode scanners are also the main way retailers are finding products when using wholesaler apps,” he says.

Bielby adds: “There’s still very much a place for paper in communications with customers, as retailers in particular value promotional leaflets and magazines. Some wholesalers have persevered with traditional ordering methods because they work for them, but the danger is that they soon won’t work for other supply chain stakeholders.”

Ahmed, meanwhile, believes the shift is inevitable when the new generation takes over: “There are massive benefits to how you operate. If it is well implemented, it can only improve your business.

“However, what I will say is that if a company is going to embrace app and ecommerce technology, then they need to be in for the long haul.

“Once you have pressed the button it’s a one-way process and there is no turning back. You are required to constantly update your frameworks,” he adds.

Clearly there is still a role to play for the traditional methods of cash and carry, but it would take a brave wholesaler who chooses not to at least investigate, if not invest, in these technologies.

Wholesaler viewpoint

“There’s room for a combination of approaches, but we must put customer choice at the heart of what we do as an industry.

“Embracing ecommerce and technology allows businesses to save time, control costs and put customers and suppliers first.

“At Pricecheck, we embrace traditional and modern approaches. We’ve got a 30-plus-strong direct sales force who love to visit customers and communicate directly. But we’re supporting them with the very best technology and this combination is working well.”