With people in the UK spending a large amount of money on their cats and dogs, Toby Hill explores the areas on which you should hone your focus

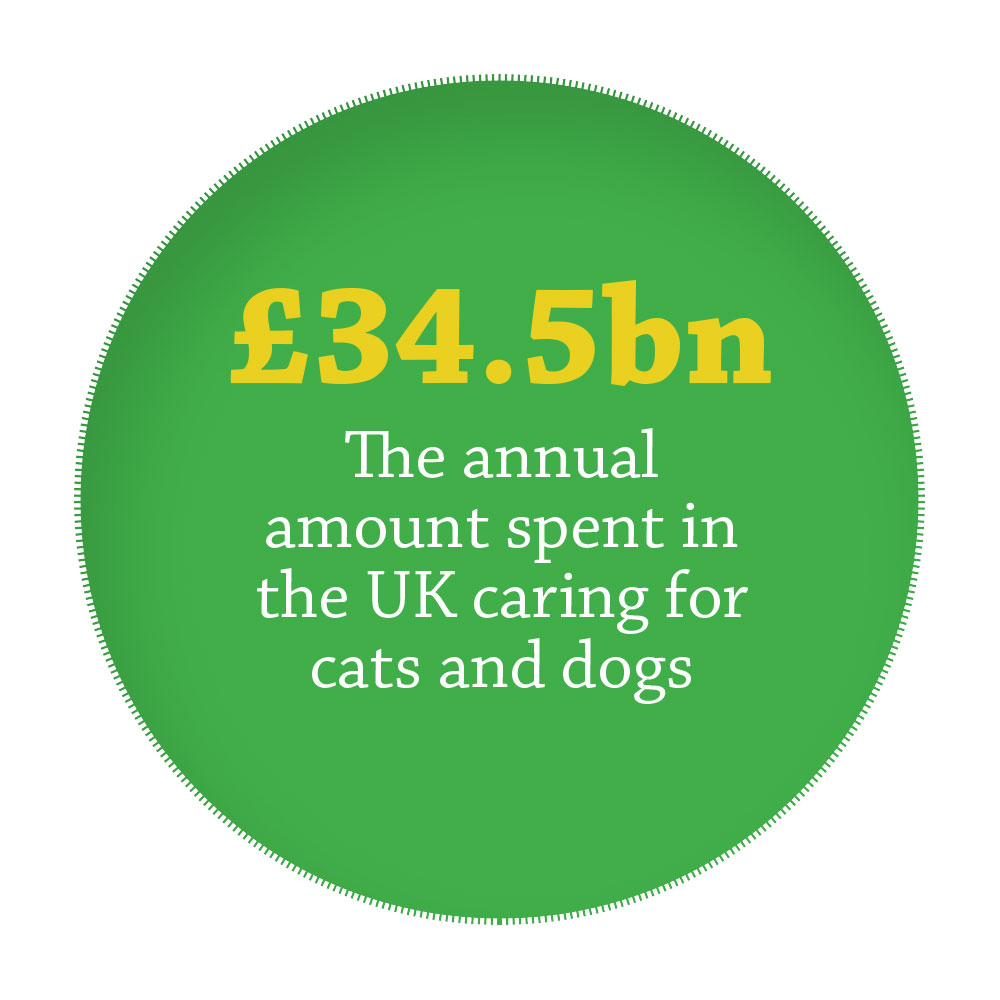

There are not many parts of the world where pet food is an essential part of the core range of every corner store, but the UK is undoubtedly one. Recent research conducted by insurance company More Than found that people in the UK spend around £24.5bn caring for their dogs every year. And while cats may be a little more independent than their canine counterparts, we still spend almost £10bn annually keeping them fed, groomed and entertained.

Still, while the UK’s love of pets has not changed, trends in what pet-owning customers are looking for definitely have. Here we outline what you need to know in order to maximise sales in the evergreen UK petcare category.

Pining for premium

Pining for premium

One key trend noticed by suppliers is a growing demand for premium products. Customers are increasingly discerning, shopping with a specific idea of what they want for their pets.

“As our humanisation of pets becomes ever more apparent, we increasingly notice shoppers seeking more premium cat food options,” observes Liz Wood, Purina UK&I market development director. Purina offers a range of premium options under its Felix brand, available in single-serve pouches such as Felix Good As It Looks Doubly Delicious, which is experiencing 24% growth year on year.

Healthy demand

Linked to premiumisation trends, growing demand for healthier human food has extended into the pet food category. People want to feel they are providing their pets with the best possible nourishment, a desire that Butcher’s Pet Care has been working hard to satisfy.

“Butcher’s Pet Care has dialled up its existing messaging so that it is easy to see that all the meat is sourced from British and Irish farms,” says Rachel Collinson, general manager for food for dogs at the brand.

“Every recipe is grain-free, with the exception of a few specially-designed ‘sensitive’ products that use wholegrain rice,” she adds

These shifts in customer awareness are positive for dogs and retailers alike, Collinson says. Pet owners are more aware of what their dogs need, and will purchase accordingly.

“Dogs have different nutritional needs to humans, naturally preferring nutrient-rich offal, liver and tripe that we humans typically shy away from,” she says. “That is why our recipes use these ‘superfood’ ingredients.”

Beyond big-name brands

While customers increasingly demand high-quality, healthier products for their pets, this does not mean they are only looking for big-name brands. A confluence of factors – the 2008 financial crash, followed by the growth of discounters such as Lidl and Aldi – has made shoppers more willing to trust their own judgement when selecting products. As Torquay retailer Chris Herring puts it: “People are not looking for the cheapest products. They want quality, but they also want value, and ultimately that is what they feel own-brand offers: better value for money.”

This is a trend also noticed at the opposite end of England by Anish Parekh, owner of Broadoak Post Office in Ashton-under-Lyne, Greater Manchester. “I have noticed a big move to buying own-label pet food,” he says. “The presentation of the products has improved, and good value is a priority for customers.”

Treats to drool over

Finally, as well as nourishing their pets, owners are also keen to treat them, fuelling a growing market in dog and cat snacks. “The snacking sector of the pet food category is now worth over £400m, which provides a huge opportunity for wholesalers to boost sales,” says Wood at Purina.

“Felix Goody Bags and Felix Crispies both incorporate delicious flavours and textures in one bag, providing cats with a selection of tasty treats,” she adds.

For dogs, too, a wide range of snacks is available. Many tune into the growing health consciousness noted earlier: snacking products that provide oral care are experiencing a boom in sales, such as Pedigree DentaStix Daily Dental Chews.

And, of course, pets have to be brought into the festive celebrations, so you could consider adding themed treats into your range with Christmas on the horizon.

The Antos Antler Dog Chew is likely to catch customers’ attention, and for those really keen to involve their pets, Good Boy Pawsley even has a Meaty Treats Advent Calendar.

Supplier viewpoint

“Consumers are increasingly interested in the health of their pets, mirroring their own health-conscious attitudes. We seek to provide our pets with the very best nutritionally, as they are considered an integral part of the family. As a result, it is vital that wholesalers pay attention to key trends and popular products in the petcare category.”

Retailer viewpoints

“We stock a few basic lines: Whiskas cat food, Butcher’s dog food and Happy Shopper dried cat food. It is not a big part of our store but we have a few regulars who pick it up. They usually have a particular brand they are attached to and always go for that, so I have maintained the same range for a few years now.”

“My main lines are Happy Shopper and Butcher’s, as well as Winalot and Pedigree. The Happy Shopper comes in at 59p, but I find the majority of my customers are willing to trade up and spend an extra 20p on Butcher’s. Both lines are pricemarked, which definitely boosts sales.”

“Over the years, we have noticed that people are buying dried food and snacks rather than traditional cans, so wholesalers could help us by offering more of those product lines. People are also increasingly eager to try new products, so offering ideas for different snacks and treats would help us, too.”

“A big growth area is our Booker own-brand range. In the past, people would never have bought own-brand pet food. But now people are buying just as much Happy Shopper as they are the equivalent brands. The margins are often better, so it is a win for everyone: the customer, the retailer and the wholesaler.”

Takeaway Points

1. Big profit opportunity – UK customers spend around £34.5bn on their cats and dogs each year.

2. Offer premium products – Shoppers are often willing to trade up, so be sure to offer a range of premium goods.

3. Healthy snack opportunity – Pet-owners are increasingly looking for healthier options such as dental chews.

4. Back products from the UK – Supporting local businesses and the environment has become a key consideration, so prioritise pet food sourced from farms in the UK.

5. Value for money – It is not all about big brands: customers are keen to try new products that offer good value for money.

Product news

Read similar: Profiting from pet care