Paul Hill looks at the confusion surrounding Brexit and its potential effect on the

wholesale channel

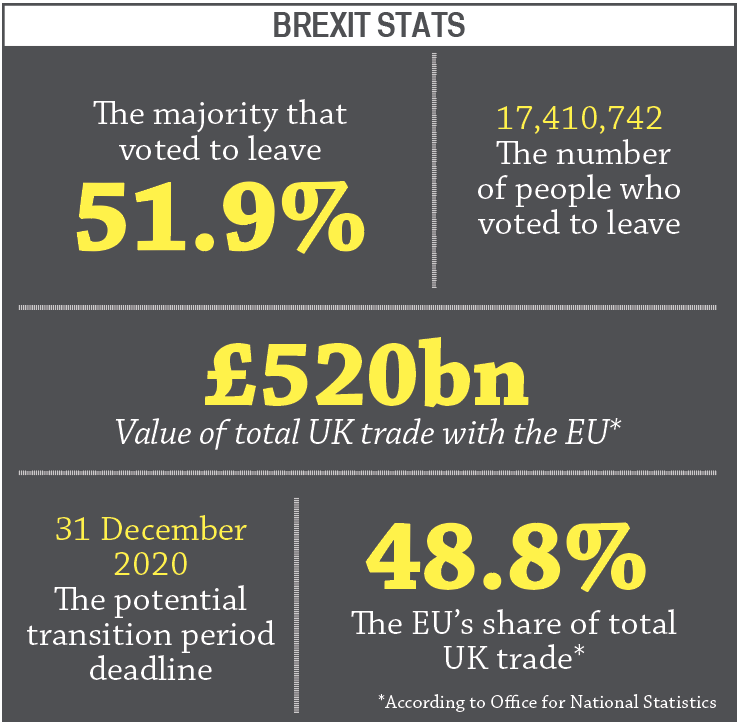

At the time of writing, the UK government is none the wiser as to what will happen on 29 March at 11pm. Nearly three years have passed since the country voted to leave the European Union and the messy divorce proceedings have only made the withdrawal agreement more confusing, leaving wholesalers perplexed and annoyed in equal measure.

The good news is that if a deal is agreed before the deadline, then a transition period will occur until 31 December 2020 to give businesses a period of time to adjust. However, if Theresa May fails to sign a withdrawal agreement and the deadline isn’t extended, there will be no transition period and EU laws would stop applying to the UK immediately.

The good news is that if a deal is agreed before the deadline, then a transition period will occur until 31 December 2020 to give businesses a period of time to adjust. However, if Theresa May fails to sign a withdrawal agreement and the deadline isn’t extended, there will be no transition period and EU laws would stop applying to the UK immediately.

There are numerous different facets to Brexit that will affect the wholesale channel, but a major one is trade tariffs, with environment secretary Michael Gove promising that the government will apply tariffs to food imports in the event of a no-deal Brexit, in order to provide “specific and robust protections”.

His remarks come with the government poised to release details of taxes on imports that would apply to thousands of products coming in from around the world, if the UK leaves the EU without a deal.

David Visick, director of communications at the Federation of Wholesale Distributors (FWD), believes preparations for a no-deal Brexit across business, government and trade associations are picking up at speed as the clock ticks towards the end of March. “In recent weeks, the FWD has been heavily engaged in discussions with the government, and we have been informing our wholesaler members of developments as they occur,” he says.

“With the outcome of Brexit discussions still highly uncertain, on the advice of the government, we have been urging our members to prepare for a no-deal scenario.

“We have had a meeting with the food minister, David Rutley, and, subsequently, hosted a roundtable for members with senior officials from Defra and DExEU to discuss no-deal planning.”

Supply issues

A huge number of differing areas were discussed at the meeting; these included border disruption, labeling problems and labour issues. However, vulnerabilities in the supply chain is one area that stands out as a major concern.

A huge number of differing areas were discussed at the meeting; these included border disruption, labeling problems and labour issues. However, vulnerabilities in the supply chain is one area that stands out as a major concern.

JW Filshill managing director Simon Hannah believes this. “As we get closer to the deadline, availability of product will be important. Suppliers are being naturally very cautious about this and focusing on products that are UK-produced and less susceptible to a no-deal scenario,” he says. “However, packaging, glass and component ingredients are often sourced via Europe, so very few products will have zero impact.

“It also needs to be acknowledged that with suppliers holding more stock pre-Brexit, this will have a cost implication that will ultimately impact the shopper as storage is expensive,” he adds.

Industry expert David Gilroy believes the impact will come through mainly in the supply chain due to the fact that stock is measured in days in the food and drink industry. He says: “There is very little buffer stock in any operation – either wholesalers or suppliers. Any disruption feeds through into shortages very quickly. Just look at the impact of the CO2 shortage last summer. So, queues at the ports will hit home very quickly.

“This also applies to packaging materials,” he explains. “Any disruption to fresh food imports could be devastating, with perishables deteriorating before entering the supply chain. This could be further exacerbated if the public starts panic buying. I witnessed this in the 1970s during the three-day week and the stores were stripped within hours.”

Meanwhile, Paul Hargreaves, chief executive of fine foods wholesaler Cotswold Fayre, has noticed a lack of confidence in the government throughout the wholesale industry over the past couple of years, which he feels could affect relations in the long term. “I think this will result in a disassociation in the future of the traditional alignment of business with the Conservative party,” he says.

However, for wholesalers at the premium end of the market, such as Cotswold Fayre, Brexit may work out well for them, according to Hargreaves. “There is an economic decline starting to kick in, but for us, the last two big declines in the UK during our 20-year history have been the two periods of fastest growth for us. This is because people tend to treat themselves with quality food products in these conditions,” he adds.

recently made an acquisition with Brexit in mind

One of the main sticking points in negotiations over the UK’s withdrawal has been the Irish backstop. It would mean that Northern Ireland, but not the rest of the UK, would still follow some EU rules on things such as food products. Henderson Foodservice is one wholesaler caught in the middle of this and has already made steps to deal with the issue through the acquisition of multi-depot foodservice company Foodco.

A spokesperson said: “Since the referendum, and despite the ongoing uncertainty surrounding Brexit, we have been scenario-planning across our business to ensure that our customers in the Republic of Ireland continue to enjoy the same high-quality trading, service and delivery support now and after the 29 March deadline.”

“The potential impact of Brexit was not the prime driver in our acquisition of Foodco. However, given that there is currently uncertainty, it will be an added advantage to have a base in Co. Meath when servicing our Republic of Ireland customers,” they added.

Opportunities

JW Filshill’s Hannah, meanwhile, does see opportunity in the exit and has called for the industry to have a proactive approach towards the issue. “It is an absolute disgrace that businesses don’t know what they’re supposed to be doing so close the deadline, but we can either sit and moan about it or instead have a proactive approach. That’s the way we’ve dealt with it,” he says.

Using the company’s close supplier relationships, Filshill has come up with a forecasting model that identifies which products are relevant. Hannah says: “With every issue there is an opportunity, and there is no better opportunity to focus on local sourcing.

“Brexit isn’t going to affect the products you purchase from the producer five miles up the road, so we’re always looking for opportunities within that.”

Hannah is also overseeing international expansion in Asia. Something that is already in existence. “The international export business isn’t by coincidence. When all the Brexit stuff was getting discussed a few years ago, we knew we needed to think of ideas to generate money outside of the EU. It was then decided that it’d be a good idea to enter the huge Asian market,” he explains. “Brexit wasn’t the only reason why we did so, but it influenced the decision.”

Hargreaves also thinks Brexit could benefit wholesale. “Retailers are going to want to de-risk importing products from the EU and wholesaler importers have the opportunity to position themselves as the experts and save retailers a lot of hassle,” he says.

Cotswold Fayre even has a Brexit team in place, he explains: “This team is already organising contingency plans, but for most people in the company, it is business as usual. We are also holding higher stock – around a month of extra stock – of the products we bring in directly from the EU or the goods that travel through the EU to reach the UK.”

Brexit could also present opportunities for the producers of home-grown and produced food and drink, says Gilroy. “This could also work well for the home market, as these products are tariff-free.

“That said, I doubt that there is enough production to meet demand. The UK currently imports more than 50% of the food and drink it consumes.

“Obviously the industry needs to increase its stock cover,” he adds. “Of course, this is an expensive exercise, but I see no option. The larger wholesalers should be, and are, stockpiling – as are the major multiples. Just as importantly, the suppliers should be increasing their stock cover.”

As you read this, the UK will be three weeks away from its exit from the EU. The wholesale industry is advised to keep in constant dialogue with the relevant personnel to make sure it isn’t caught short and the FWD will be the first port of call.

“In the remaining weeks before the end of March, we will hold further meetings between members and officials,” says Visick. “We will keep our members informed on key decisions as they are made, including post-Brexit tariffs on imports.”

Brexit preparation checklist

1. Work on a forecasting model

2. Keep in constant dialogue with suppliers

3. Stockpile sensibly

4. Analyse labour availability

5. Consider local and non-EU options

such as Dover when the UK leaves the EU

Industry viewpoints

“As the UK prepares to leave the EU, the government has a unique opportunity to revisit EUTPD II and raise standards, and work in the public’s interest to increase consumer confidence in the tobacco category.”

“We’ve talked about a ‘Breggsit’ storm brewing, but it’s now here, and that won’t change, deal or no deal. We will work with manufacturers and retailers to manage their requirements as best we can, but it needs to be made clear that those conversations need to happen sooner rather than later.”