Paul Hill finds out how Coca-Cola Europacific Partners (CCEP) and Costa Coffee are helping wholesalers grow sales in the ready-to-drink (RTD) chilled coffee category

CCEP – together with its brand partners in Great Britain – has always been proactive in supporting the wholesale channel, and recently visited Parfetts’ Stockport depot and Dhamecha’s Hayes site to help the businesses grow their sales of RTD chilled coffee, one of the fastest-growing segments within the soft drinks category (1). Costa Coffee RTD is manufactured and distributed by CCEP in GB.

“It’s great to visit our wholesale partners to highlight the RTD chilled coffee opportunity, and to offer advice on what they can do in depot and online to drive sales of the segment and of our growing Costa Coffee RTD range within it,” said Matthew O’Hagan, senior portfolio execution manager at Costa Coffee FMCG.

“We’re always more than happy to work with CCEP and its brands here in Stockport. Activity like this is great for us and our customers,” added Jamie Ferguson, head of marketing at Parfetts.

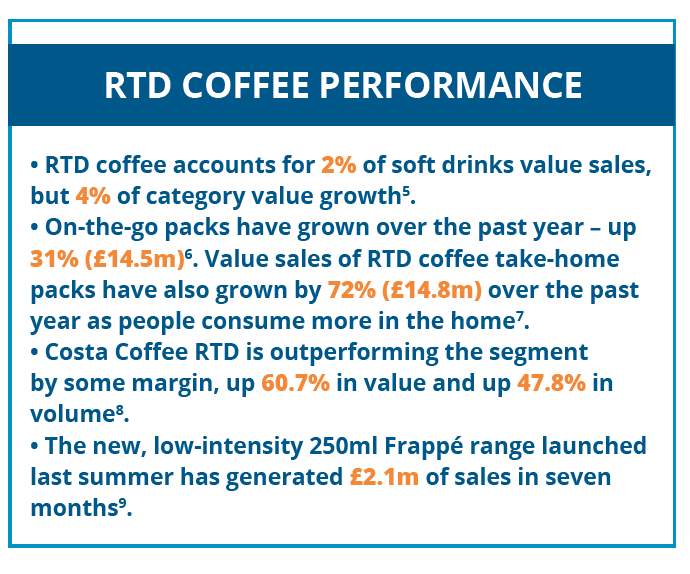

Costa Coffee’s RTD range is currently outperforming the wider segment – up 61% in  value and 48% in volume(2) – which presents a huge opportunity to wholesalers. The range includes two core Latte variants, a Double Shot Flat White and two tasty, low-intensity 250ml Frappés for treat occasions – covering all the consumer need states identified in CCEP and Costa Coffee’s RTD Coffee Vision, which is designed to identify and unlock opportunities for growth.

value and 48% in volume(2) – which presents a huge opportunity to wholesalers. The range includes two core Latte variants, a Double Shot Flat White and two tasty, low-intensity 250ml Frappés for treat occasions – covering all the consumer need states identified in CCEP and Costa Coffee’s RTD Coffee Vision, which is designed to identify and unlock opportunities for growth.

Dhamecha Hayes depot manager Vinod Ramgi said: “We have a close working relationship with CCEP and its brands in our Hayes depot. We’re always looking for support on how to gain the most from emerging, fast-growing segments like RTD chilled coffee and look forward to seeing what this activity delivers.”

As well as supporting wholesalers in leveraging the RTD chilled coffee opportunity in depot, CCEP provides category advice and sales tools to help convenience customers maximise sales in stores, during the summer period and beyond. The ambition is that wholesalers and retailers are aligned on the opportunity.

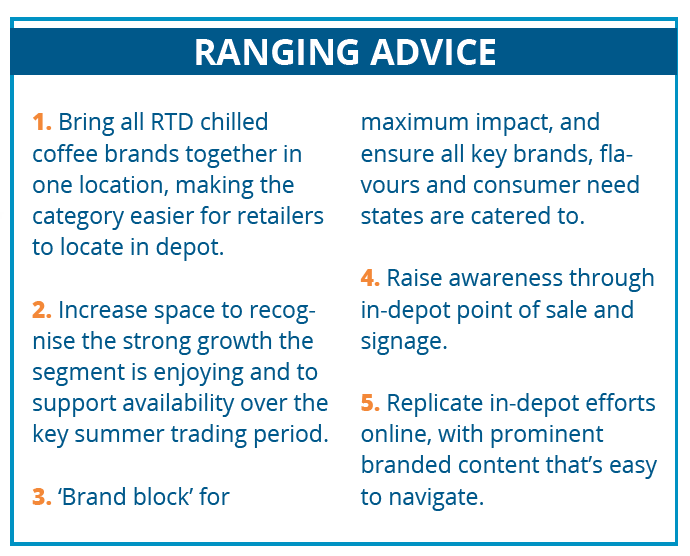

“It’s not just about selling to the end user. There’s more wholesalers can do to raise awareness of this fast-growing category within soft drinks,” added O’Hagan. “Bringing all RTD chilled coffee brands together in one location in depot will make it easier for retailers to locate. We also recommend increasing space to recognise the strong growth the segment is enjoying and to support availability over the key summer period. These principles carry through to convenience retailers.”

“The insight we have gained from CCEP and Costa Coffee has been really valuable, and we’ll look to implement this into our wider operations while also helping to educate our retailers with what we’ve learnt,” explained Ferguson. Ramgi echoed these thoughts: “It’s been great having Costa Coffee here in Hayes. We’re excited to see how the Costa Coffee portfolio and the wider segment performs moving forward.”

By not just offering advice on specific products and rather championing the entire category, CCEP aims to put its wholesale partners in a fantastic position to be successful in what is a hugely exciting and fast-growing segment.

By not just offering advice on specific products and rather championing the entire category, CCEP aims to put its wholesale partners in a fantastic position to be successful in what is a hugely exciting and fast-growing segment.

Matthew O’Hagan, senior portfolio execution manager, Costa Coffee FMCG: “RTD chilled coffee is already worth a massive £276m and up nearly 20% in value, adding £45.5m over the past year alone(3). The segment is also in double-digit volume growth(4), demonstrating that more shoppers are buying RTD coffee more often.”

1Nielsen Total GB incl. discounters, MAT val w/e 31.12.22, 2Nielsen Total GB incl. discounters, MAT vol w/e 31.12.22, 3Nielsen Total GB incl. discounters, MAT val w/e 31.12.22, 4Nielsen Total GB incl. discounters, MAT vol w/e 31.12.22, 5Nielsen Total GB incl. discounters, MAT val w/e 31.12.22, 6Nielsen Total GB incl. discounters, MAT val w/e 31.12.22, 7Nielsen Total GB incl. discounters, MAT val w/e 31.12.22, 8Nielsen Total GB incl. discounters, MAT val and vol w/e 31.12.22, 9Nielsen Total GB incl. discounters

All photos: Stewart Allan