Paul Hill looks at the changing political situation and Brexit and what it means for the wholesale industry

Recent months have seen a seismic shift in the political landscape of the UK and EU. As well as Boris Johnson winning a large Conservative majority and overseeing a major cabinet reshuffle, Brexit has been signed off, with the country now undergoing a transition period that will last until 31 December 2020.

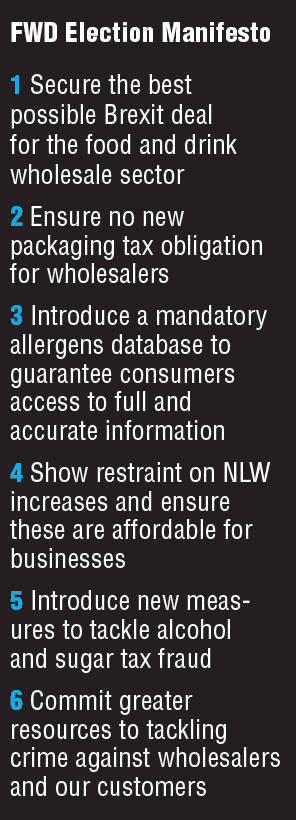

Last year, the Federation of Wholesale Distributors (FWD) revealed its election manifesto in which it identified six priorities it felt the new government needed to address. “We have had a wide range of engagement with politicians and officials since the election and received positive responses to our policy proposals,” explains its chief executive, James Bielby. “Following the government reshuffle, we will be meeting the new ministers to highlight the vital role wholesale plays in the economy and wider society.”

The FWD is constantly monitoring political developments, he says, as it looks at both the business impact of policy and the likelihood of it being taken forward in order to prioritise the trade association’s work. “For example, minimum unit pricing (MUP) in England would have a huge impact on the wholesale trade, but we also know there is no prospect of it being introduced by Westminster in the immediate future, as it has been in Scotland and, later this year, Wales.”

The FWD is constantly monitoring political developments, he says, as it looks at both the business impact of policy and the likelihood of it being taken forward in order to prioritise the trade association’s work. “For example, minimum unit pricing (MUP) in England would have a huge impact on the wholesale trade, but we also know there is no prospect of it being introduced by Westminster in the immediate future, as it has been in Scotland and, later this year, Wales.”

He continues: “Similarly, the Environment Bill contains much that could affect wholesale, and as it has now been introduced, we will we be working closely with Defra throughout the year to ensure the role of wholesale and its customers are considered in any future policies on things like deposit return scheme (DRS) or extended producer responsibility. Alongside Brexit, we expect policies on environment and infrastructure to be the main focus of the Johnson administration.”

Despite it being signed off, Brexit will also remain an ongoing talking point. “The FWD will work with the government and other trade associations on the impact of the future relationship on the food and drink sector, in particular the Free Trade Agreement, as well as planning for a potential no deal after 31 December, and advising wholesalers accordingly. “It is business as usual until the end of the year,” says Bielby.

Meanwhile, Scottish Wholesale Association (SWA) chief executive Colin Smith has called on Boris Johnson to put business first and push for a frictionless trade deal with minimum tariffs or trade barriers. “Following a long period of political uncertainty, we want to see our members and the wider wholesale sector invest for the future and prioritise long-term growth,” he says. “It is crucial that the government works with our industry.

Read more: What will the effects of Asda entering the wholesale channel be?

“Our members, many of them independent businesses, support other independent businesses, public services and provide a lifeline to remote and island areas.

“We urge the government to provide a level playing field that allows our members to grow, supports local workforces and communities, and helps them work in partnership with customers and suppliers to create a healthy wholesale sector with a long-term future.”

The SWA chief also urged the government to take on board the implications of

the National Living Wage increase while calling for further measures to tackle alcohol duty fraud and sugar tax evasion. He also called on the government to review its manifesto pledge on introducing a DRS.

Foodservice is a sector also keeping a firm eye on the Brexit deal, with The Country Range Group already taking steps to stock-build where necessary, as it accounts for products that may be at a higher risk of supply issues. “This is something we may need to consider again in the final quarter of this year,” said a statement from the buying group. “We have worked closely with key industry bodies to stay close to what the government are saying as well as attending workshops and events aimed to add clarity to what is a very unique situation.

“Our key focus, though, has been maintaining good stock levels to supply customers and support their businesses, as well as providing regular updates to customers with what we are doing.”

Tobacco legislation is a grey area for the government to tackle, particularly in the form of the upcoming menthol ban and confusion that surrounds it.

A recent survey of 350 retailers by JTI highlighted the need for further education and additional support on the specifics. Key findings include 23% of those surveyed not knowing that capsule cigarettes will be outlawed, 50% not aware of the penalties they could incur for non-compliance and 34% incorrectly believing that mentholated smoking accessories will be banned.

Brexit has also brought up the future of another piece of legislation – track and trace on tobacco. “As it is an EU-wide system, the UK may no longer have access at the end of the transition period,” explains Bielby. “The requirements within the regulations will continue to apply to businesses involved in the supply of tobacco products operating in the UK, but what happens after that point appears to be undecided and is unclear.”

The FWD will continue to work with HMRC on plans for track and trace and keep members informed, but from 20 May, it still stands that wholesalers can only sell cigarettes and hand-rolling tobacco to retailers who have the relevant EOIC or FIC codes.

Read more: FWD issues election manifesto