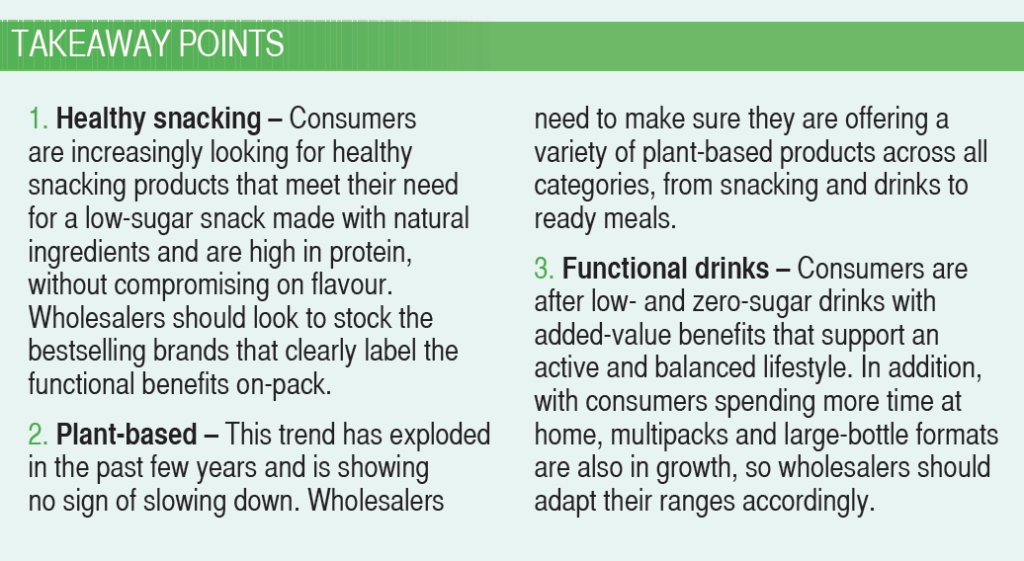

As the general public has become more health-conscious over recent years, wholesalers have been required to alter their ranges in order to adapt. Katherine Brook takes a look at the fast-evolving health & functional market

Over the past few years, consumers have become increasingly more health aware, with 65% of people agreeing that they are proactively trying to lead a healthier lifestyle(1).

They now want to know exactly what’s in the products they are eating and drinking, how much sugar, fat and protein they contain, and whether they’re vegan-friendly. As such, the health and functional market has witnessed some enormous developments, which has only been propelled in the past 12 months.

“One of the biggest factors contributing to consumer purchase decisions is whether a product is natural and plant-based, with health professionals across the world advocating a predominantly plant-based diet as the healthiest option,” says Tom Stancliffe, co-founder of Tribe, a natural sports nutrition company.

“One of the biggest factors contributing to consumer purchase decisions is whether a product is natural and plant-based, with health professionals across the world advocating a predominantly plant-based diet as the healthiest option,” says Tom Stancliffe, co-founder of Tribe, a natural sports nutrition company.

In the UK, the number of vegans quadrupled between 2014 and 2019(2), and with 24% of consumers actively looking for vegan or vegetarian products(3), brands have had to become innovative in order to stay relevant and competitive.

How have businesses adapted to the soft drinks sugar levy

Healthy snacking

“Sports nutrition is a key driver of the snacking category, with health-conscious consumers placing high importance on being physically active and the trend towards protein-filled treats showing no signs of diminishing,” says Georgina Crook, Trek senior brand manager.

“And with 62% of consumers agreeing that sports nutrition products made

“And with 62% of consumers agreeing that sports nutrition products made

with plant proteins are a healthier choice, and 53% concerned about artificial sweeteners(4), there has never been a better time for wholesalers to capitalise on the opportunity.”

To meet this demand, Trek has recently launched a new range of Power Bars, which contain 15g of plant-based protein, as well as adding two new flavours to its already popular Protein Flapjack range. Crook says these are perfect for consumers looking for a healthy vegan snack that provides slow-release energy.

Functional drinks

The sports and energy category is worth £1.3bn, with growth totalling more than £25.3m compared with last year(5). This growth has been fuelled by an increasing demand for functional energy, which has added more than £130m to the category since 2019(6). “Consumers want to look and feel good, and as a result, wellness is one of the latest soft drinks segments to come under the spotlight(7),” says Phil Sanders, out of home commercial director at Britvic.

Functional energy includes drinks with more natural qualities, such as Lucozade Revive, and Purdey’s, which uses only natural ingredients and vitamins for a refreshing uplift. Alongside this, low- and zero-sugar products have also risen in popularity, growing collectively by more than 60%8. Energy drinks brands are shifting their portfolios to reflect this, with Carabao offering drinks containing only 63 calories per can, and well-known brands such as Red Bull and Lucozade pushing their low- and no-calorie versions.

The way people are consuming drinks is changing, too. Energy drinks, such as Coca-Cola Energy, were predominantly bought for on-the-go consumption, but now consumers are spending more time at home, purchase rates of multipacks and drink-later formats have steadily increased by 9.4% and 8%, respectively. “Consumers are looking for an all-day energy uplift while working from home, so it’s important that wholesalers have a large-format offering in depot to cater for this demand,” says Matt Gouldsmith, channel director, wholesale, at Suntory Beverage & Food GB&I.

1 CGA Market Review 2018, BrandTrack Survey, April 2019 2 Ipsos Mori surveys, commissioned by The Vegan Society, 2016 and 2019 3 Research from Toluna 2020 4 Attitudes toward Sports Nutrition, Mintel, August 2019 Mintel, Attitudes towards Sugar & Sweeteners, Sept 2019 5 Nielsen Scantrack Value Sales 52wks to Aug 2020 6 Nielsen Scantrack Value Sales 52wks to Aug 2020 7 Mintel – Attitudes towards Premium Soft Drinks: Inc Impact of COVID-19 – UK – April 2020 8 Take Home Soft Drinks – Spend – Value – 20 w/e Aug 18 vs. 20 w/e Mar 2018. Based on Products with known sugar values only, excludes estimates 9 Nielsen Answers, Energy Stimulation Database to 22 August 2020: YTD Unit Sales to 22.08.20 – From 36 Energy Stimulation Launches with Sales 100 Units or greater 10 CGA Market Review 2018, BrandTrack Survey, April 2019 11 Nielsen RMS, Total Coverage, Wellness (as defined by Britvic) & Total Soft Drinks, Value % Change, 2YR CAGR – Data WE 28 March 2020