Breakfast is a meal that 97% of Britons eat each week, according to Kantar data, and yet it has also been a market that many independent wholesalers haven’t historically focused on. This has changed.

With the cereal market alone worth £70m a year and on-the go options such as breakfast micro-snacks worth £17.7m, it is clear that this has become a key market for both retail and foodservice customers.

This is good news for brands with a long-standing connection to this key meal time.

“Breakfast is one of the fastest-growing areas of the food market, with consumers taking a vested interest in not only what they consume and how they prepare their meals, but how the end result looks, too,” says Levi Boorer, customer development director at Nutella brand owner Ferrero UK & Ireland.

Boorer adds that one of the long-term impacts of the pandemic has been a widespread trend for consumers taking a little more time preparing breakfast. “More recently, and during the 2020 lockdowns, we saw consumers spending longer preparing meals, with the average breakfast taking seven-and-a-half minutes, as shoppers sought to get creative and try something a little less ordinary, such as croissants, crumpets or waffles.”

Of course, it is also true that many Britons are busier than ever, which has led to supplier investment in quick options for shoppers on the go.

Monisha Singh, shopper marketing manager at Kepak Consumer Foods, says its Rustlers All Day Breakfast Sausage Muffin has become a key multi-million pound brand in this segment of the market.

“With research from Kantar showing enjoyment is the number-one priority for breakfast (78%) alongside practicality (34%), Rustlers enables wholesalers to meet retailer and shopper demand for convenient breakfast solutions,” Singh says.

The team at Kepak has created a guide for wholesalers who want to maximise this opportunity in their depots.

Singh says: “It is crucial to make the chilled room in depots as quick and easy as possible to shop for retailers. Stocking SKUs by occasion, including breakfast, helps retailers maximise the dual-siting opportunities in their stores. Keeping the chilled room tidy and clean also allows the retailer to navigate quickly and find what they came looking for with ease.”

Singh adds that consistent availability avoids lost sales and a strong, well-merchandised range will further boost sales.

“We recommend blocking products in good and better ordering from left to right, which highlights clear options to trade up. Blocking similar products together also helps with ease of shop,” Singh adds.

One breakfast option that straddles both the at-home and on-the-go opportunities is baked goods such as croissants, pains au chocolat and Danish pastries. Stéphanie Brillouet, marketing director at Délifrance, says the sector has performed well despite the pandemic.

“Lockdown affected consumption habits, with 34% of consumers increasing at-home breakfast pastry consumption. This is expected to change, however, with 17% saying they will eat more pastries at home, 30% saying they will eat more in hospitality and 26% that they will eamore on the go.”

To further widen this opportunity, Brillouet says her firm has developed a range of healthier and vegan friendly options. “Other strong breakfast focuses are health and wellness, and vegetarian and vegan options. This is one reason why we introduced our ‘Feel Good’ vegan croissant range, with spelt-based croissants and a new vegan croissant, which perfectly replicates a classic French butter croissant using wheat flour and shea butter,” she says.

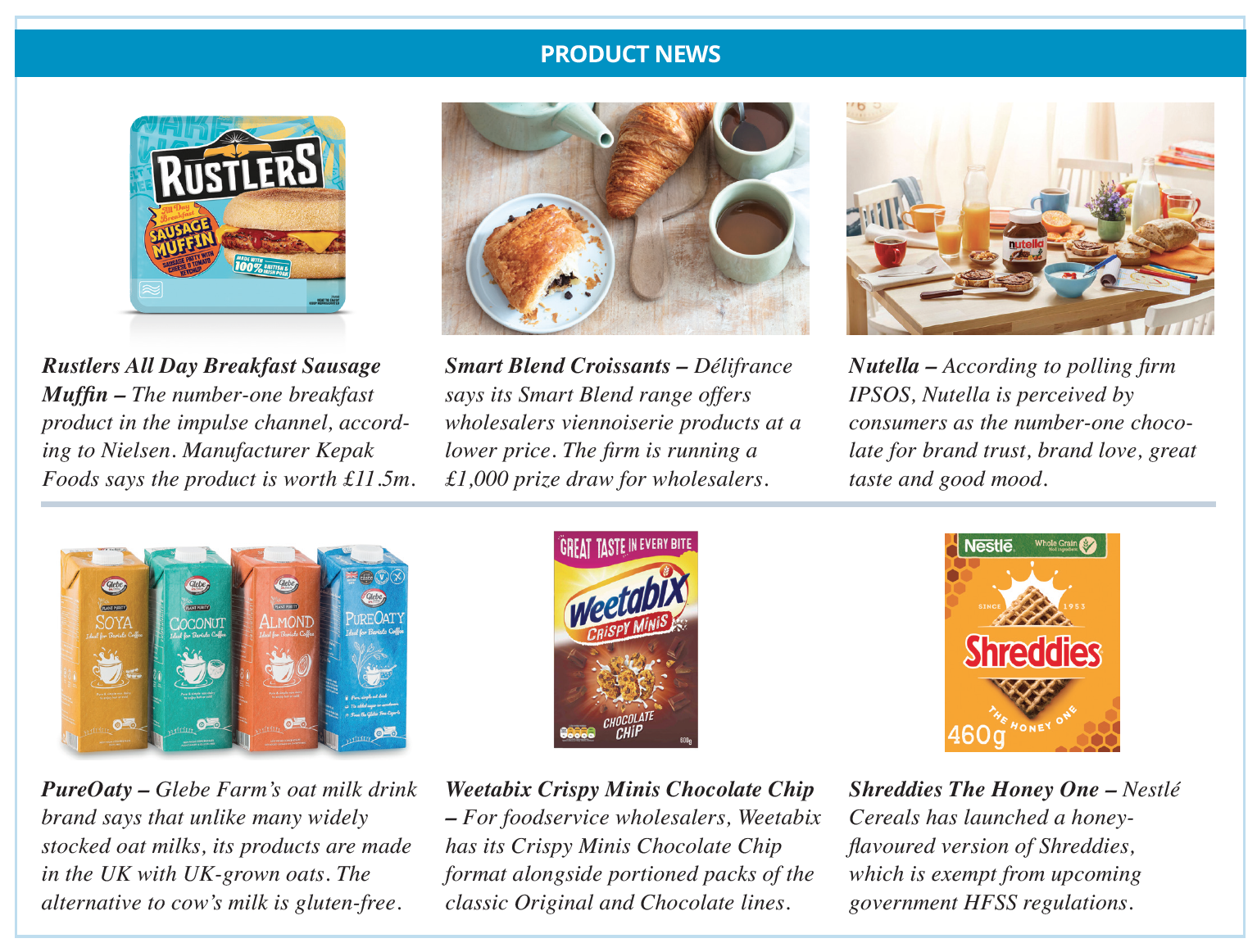

Building on the rise of vegan options, Glebe Farms recommends wholesalers focus on the alternative milks market.

“A recent Mintel study showed up to one in three Brits now drink plant-based milk, with oat drinks officially topping the list of alternatives, reaching a market value worth £146m,” says Phillip Rayner, co-founder & owner of Glebe Farm Foods.

Glebe Farm’s PureOaty range sits alongside a wider range of alternative milks produced by the firm, including Almond, Soya and Coconut.

Weetabix is another supplier that sees potential for growth in this market and the firm says, despite the pandemic, the number of out-of-home breakfasts has grown by more than 20% in recent years.

“Weetabix recently introduced some exciting new additions to its foodservice portion pack range to ensure out-of-home operators make the most of breakfast sales,” says Darryl Burgess, head of sales at Weetabix.

“Weetabix Original and Weetabix Chocolate are available as two-biscuit portioned packs, and, for the first time in foodservice, Weetabix Crispy Minis Chocolate Chip is available in a 40g portion pack.”

As with Délifrance, Burgess also sees healthier options as being a crucial trend to follow. With the arrival of restrictions on the promotion of high fat, sugar and salt products (HFSS) in October, Weetabix recommends stores offer a range of healthier options in store.

In the cereal bar category, Weetabix recently launched a White Chocolate, Raspberry & Shortcake Alpen Light bar, which contains 70 calories and is high in fibre.

One recent launch directly aimed at meeting HFSS regulations is Nestlé Cereals’ Shreddies The Honey One. Honey-flavoured cereals is a fast-growing trend and the supplier says it is part of a transition that has seen it remove 59 million teaspoons of sugar and three million teaspoons of salt from its products since 2003.

Finally, suppliers say consumers are also seeking out brands they know and trust in uncertain times. This benefits wholesalers that serve both foodservice and retail customers.

“It’s clear that 2020 was a challenging year for shoppers, so it’s understandable that in hard times, consumers turn to products they trust for great quality and taste,” says Ferrero’s Boorer. As depots plan out a profitable strategy for the breakfast category, these brands also provide great partners for success in the months ahead.