Olivia Gagan explores how you can make your soft drinks range as profitable as ever in the aftermath of the Soft Drinks Industry Levy

Soft drinks have long been a mainstay of the convenience channel, and it is a non-negotiable category for bars, pubs and restaurants. However, the industry has changed dramatically in recent years. The Soft Drinks Industry Levy (or ‘sugar tax’) is live. Manufacturers have been forced to reformulate their drinks to reduce the sugar content and so avoid price rises caused by the sugar tax.

Now more than ever, you need to stock a balanced range in-depot to cater for all needs and types of consumer, from the health-conscious to those who do not mind paying a bit more for an indulgent treat. But consumers on the whole are taking a greater interest in the nutritional content of their drinks.

Now more than ever, you need to stock a balanced range in-depot to cater for all needs and types of consumer, from the health-conscious to those who do not mind paying a bit more for an indulgent treat. But consumers on the whole are taking a greater interest in the nutritional content of their drinks.

Simply opting for a broad sweep of fizzy drinks and a few bottled waters will no longer suffice. Here is how to make the most of your soft drinks range.

Water works

Water can get a bad rap as the least exciting soft drink available, but consumers are increasingly buying bottled water and manufacturers are coming up with ever-more inventive ways to drive interest.

Trystan Farnworth, commercial director, convenience and impulse at Britvic, says: “Consumers needing a pick-me-up have for a long time favoured the quick-fix, high-energy solution. But lately we have seen them increasingly reject the many existing products in the category because they are dissatisfied with a short-term boost followed by a ‘crash’ in energy.

“Wholesalers should consider dedicating enough space to emerging, healthier categories such as water and ‘water plus’ to tap into this trend.”

The availability of water-plus drinks – those with added health-related ingredients, such as herbs or vitamins – is increasing. Last year, Lucozade Ribena Suntory (LRS) launched Lucozade Sport FitWater, containing magnesium and calcium, which are claimed to help with muscle function and fatigue. Nichols has created the Feel Good Infusions range, which consists of water infused with three different combinations of flavours. Meanwhile, Britvic’s Purdey’s is a sparkling water containing herbs and vitamins.

Red Bull strategy and planning manager Mark Bell says water-plus drinks are here to stay, thanks to “busier lifestyles and increasingly time-poor consumers – products that deliver added value for a range of occasions, such as multivitamins, protein or a functional energy boost, will continue to be popular”.

It’s not unusual

While awareness of the health benefits of soft drinks is growing, Red Bull’s Bell says: “Taste and refreshment are always going to be key drivers in the soft drinks market.” As a result, Ed Jones, senior customer marketing manager at Vimto, says keeping consumers on their toes with new and unusual flavours is paramount.

While awareness of the health benefits of soft drinks is growing, Red Bull’s Bell says: “Taste and refreshment are always going to be key drivers in the soft drinks market.” As a result, Ed Jones, senior customer marketing manager at Vimto, says keeping consumers on their toes with new and unusual flavours is paramount.

“While health is important, taste remains at the forefront of the category. There is an ever-growing appetite for more exotic flavours,” he suggests.

Barr Soft Drinks marketing director Adrian Troy agrees. This month, Barr has launched Rubicon Street Drinks in 330ml cans to capitalise on this desire for new and unusual flavours. The range’s Sharbat, Agua Fresca and Nimbu Pani flavours reflect traditional popular soft drinks of Turkey, Mexico and India, respectively.

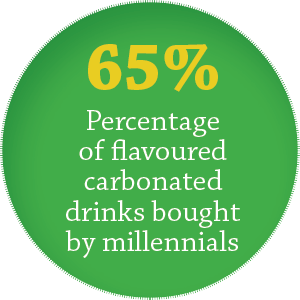

Amy Burgess, trade communications manager at Coca-Cola European Partners (CCEP), says it pays to keep an eye on such launches of new flavours. “One of the key consumer groups driving innovation in soft drinks is millennials, who consume around 65% of flavoured carbonates in Great Britain. They are increasingly health-conscious but are also looking for new and exciting flavours. This year has already seen a raft of new flavours join our portfolio.”

Zero can be hero

Perhaps the biggest impact of the sugar levy has been the explosion in zero-sugar variants of long-established bestsellers. LRS’ Scott Meredith says low- and no-calorie options should now form a key part of a retailer’s range.

He adds: “Like most other suppliers, LRS now has low- or zero-calorie variants for all its key brands: Lucozade Zero, Lucozade Sport Low Cal, Ribena Light and Orangina Light.

“These drinks are important in attracting healthier shoppers looking for low-calorie options, particularly as research shows that these shoppers also typically spend more in-store.”

Colas, whether original or in new variants, continue to be bestsellers for manufacturers. According to researcher IRI Marketplace, last year saw cola sales grow by £21m, with three-quarters of this growth coming from the diet segment. Britvic’s Farnworth says this was reflected in sales. “As consumer demand continued to move towards healthier soft drinks, leading low-calorie cola brands benefitted, with Pepsi Max growing the most.”

Once again, taste is a major consideration. Farnworth notes: “It is important for wholesalers to offer a broad low- and no-sugar range, as more and more consumers are looking for these healthier options. However, taste is the number-one factor when choosing a soft drink and consumers value choice, so it is important to provide a range that does not compromise on taste. This will be key to unlocking future sales growth in the convenience and impulse channels.”

CCEP recently unveiled two new variants of Diet Coke and one of Coca-Cola Zero Sugar to meet consumer demand for light colas and highly-flavoured options, according to Burgess.

“Exotic Mango and Feisty Cherry have joined the Diet Coke portfolio, which is the first time the brand has introduced new flavours since 2003,” she says. “The new flavours have been designed to help retailers and wholesalers tap into the growing popularity of light colas and the growing consumer trend for unique, exciting options.”

No booze, no problem

It is also worth considering your range of zero-alcohol wines. Andrew Turner, director of wine at Halewood Wines & Spirits, says: “In this ‘adult’ soft drinks space, sales of low- and no-alcohol wines are soaring, as millennials are increasingly making lifestyle choices to reduce their consumption of alcohol.

“These consumers are willing to experiment when it comes to unusual soft drinks, but they are not willing to sacrifice taste or quality.

“Alcohol-free wines allow drinkers to pop a cork, offering a celebratory feel for special events, ensuring those going alcohol-free can still feel they are part of the occasion.

“It is important for wholesalers to be aware of what consumers now expect to be able to purchase, as there has been a marked increase in the preference for premium and adult soft drinks.”

Look to local

Retailers are increasingly adding more square metres of chilled space to their stores to meet demand from customers for cold, ready-to-drink soft drinks. But this also means you may have to think about how best to make room for this growing category.

Red Bull’s category development manager, Rich Fisher, says: “Space can be a big challenge for wholesalers, as many look to consolidate their range. Red Bull advises wholesalers to stock the most efficient range to drive the greatest value, while category space should be aligned with sales share to maximise revenues. I would suggest 50-60% of soft drinks space should be allocated to your top five brands.”

Barr’s Troy says it can pay to focus on local and regional trends. Irn-Bru is famously popular in Scotland, for example. Meanwhile, Vimto has traditionally had a stronger presence in northern England than in the south. As a result, Barr is devoting a multimillion-pound advertising campaign to try to counteract Irn-Bru’s regional divide over the summer.

“The ‘one size fits all’ approach does not work for soft drinks,” he says. “We work with wholesalers and retailers to ensure that they prioritise their fixtures using local sales-out data rather than the national picture.”

“Our advice to wholesalers includes creating your own core range from your sales data of the top 20 SKUs in each sub-category, rather than the national picture. This will tailor your ranges to regional and local tastes.”

Troy also urges you to stock pricemarked packs and cases, saying they are an “excellent way to generate profit and sell through quickly to maximise cash flow”.

Sundher Sander, S&S One Stop, Leamington Spa, Warks

“Water is the big seller for us, from still and sparkling to flavoured. Water gets picked up now in a meal deal with sandwiches – it seems people are becoming more health-conscious.

“Water is the big seller for us, from still and sparkling to flavoured. Water gets picked up now in a meal deal with sandwiches – it seems people are becoming more health-conscious.

“It depends, though – we are finding our customers from local building sites are still going for full-sugar drinks, despite the sugar tax.”

Ashley McCarthy, Ye Old Sun Inn, Colton, N Yorks

“There is less interest in big soft drinks brands – customers want to

“There is less interest in big soft drinks brands – customers want to

try the smaller, emerging ones. Natural flavours are popular, too.

“As part of the influx of gins into the market, tonic waters have become a drink in their own right – we serve them in gin glasses so non-drinkers get the theatre of a G&T without the alcohol.”

Mo Razzaq, Family Shopper, Blantyre, Glasgow

“This year, I have opened a dessert parlour and café in my store. Post sugar-levy, people still want sweet treats – it is just that canned and bottle drinks are no longer the only option, and people want something special and unique.

“This year, I have opened a dessert parlour and café in my store. Post sugar-levy, people still want sweet treats – it is just that canned and bottle drinks are no longer the only option, and people want something special and unique.

“In the dessert bar, fresh milkshakes my staff make on the premises fly off the shelves.”

Nilesh Patel, Nils Convenience Store, Ilford, Essex

“Rubicon is doing well. Rubicon Spring and flavoured waters in general are popular on warm, sunny days. The sugar tax has not really affected things – classics like Coca-Cola always sell.

“Rubicon is doing well. Rubicon Spring and flavoured waters in general are popular on warm, sunny days. The sugar tax has not really affected things – classics like Coca-Cola always sell.

“Customers care about price above all else. They have not complained about the taste of reformulated drinks, but they have complained about price.”

Product news

Top tips

Scott Meredith

Scott Meredith

UK sales director,

Lucozade Ribena Suntor

“As the summer season continues, it is important retailers are still stocking up to meet demand for impulse soft drinks during this warmer weather.

“In fact, for every one-degree temperature change, soft drinks sales increase by 1.6%, showing just how big the opportunity from soft drinks can be. Juice drinks are important when consumers are looking for great-tasting, fruity refreshment on summer days. Sales of Ribena peak by almost 22% in the summer months.

“Now that the Soft Drinks Industry Levy is in force, it is more important than ever that wholesalers are able to offer their customers a broad range of soft drinks at competitive prices.”