Toby Hill talks to crisps and snacks suppliers about shifting trends and alternating buying habits, and asks how wholesalers can avoid the pitfalls and maximise the possibilities in this fast-changing category

The crisps and snacks sector is an ever-changing one, with consumers increasingly dropping the big weekly shop in favour of frequent visits to local stores. Pladis’s marketing director, Stuart Graham, observes this. “An increase in shopping frequency can result in an increase in impulse purchases, and as long as wholesalers stock the right savoury snacks to help convenience, then retailers can capitalise on this,” he says.

Simultaneously, trends towards healthier eating are creating new challenges for wholesalers seeking to maximise sales of traditional snacking products. But they are also opening up new opportunities, as suppliers respond to demand for healthy snacking with a burst of innovative NPD. This hard work is paying off. Today, in the convenience channel alone, savoury snacking is worth £344m, representing a growth of 10%, according to Kantar statistics. In this guide, we ask leading suppliers how wholesalers can avoid the pitfalls and maximise the possibilities in this fast-changing category.

Healthier habits

By far the most powerful trend reshaping the snacking market in recent years has been the desire for healthier lifestyles. “Healthier snacking is a growing trend, which shows no signs of slowing down,” says Katy Hamblin, marketing manager at Pipers Crisps, who notes that the total “better for you” market is now worth nearly £125m – with year-on-year growth of 9.3%.

By far the most powerful trend reshaping the snacking market in recent years has been the desire for healthier lifestyles. “Healthier snacking is a growing trend, which shows no signs of slowing down,” says Katy Hamblin, marketing manager at Pipers Crisps, who notes that the total “better for you” market is now worth nearly £125m – with year-on-year growth of 9.3%.

To meet this demand, Pipers has developed a range of snacks that break away from the fried potato mould.

For example, Pipers Crispeas – made with British peas – contain 91 calories per pack, and are available in three flavours: Matar Paneer, Salsa Verde and English Mint.

Similarly, biscuit manufacturer Pladis is tapping into healthy living trends with the launch of two new snack bars. Go Ahead Nutty Crunch and Go Ahead Fruit & Nut Breaks both contain less than 100 calories as well as providing a good source of fibre.

Focusing on healthier snacking can help boost margins for both wholesalers and their retail customers. “Interestingly, 40% of shoppers expect to pay a premium for healthy snacks,” says Paul Wheeldon, wholesale and foodservice channel controller at Eat Real. “This is good news for retailers and wholesalers who should be prepared to increase shelf space for healthier snacks in order to capitalise on this growing demand.”

Simply Fresh retailer Sandeep Bains has recently done just that, cutting down on grocery facings to create space for two bays dedicated to healthy snacking products. “It’s not just a case of meeting current trends, but these are quality products, and having a prominent section helps create the right impression for my store,” he says. Bains relied on specialist wholesalers such as Epicurium to shape his range, following their data on bestselling SKUs.

Free-from desire

Mirroring trends towards healthier eating is demand for free-from products. Of particular relevance to the snacking category are snacks that are vegan or gluten-free.

Mirroring trends towards healthier eating is demand for free-from products. Of particular relevance to the snacking category are snacks that are vegan or gluten-free.

“The Eat Real range of plant-based gluten-free and vegan snacks includes Hummus, Lentil & Quinoa Chips, Quinoa Puffs and Veggie Straws, all of these are available in 80g-135g sharing bags and a wide range of innovative flavours including Mango & Mint, Chilli Cheese and Paprika,” says Wheeldon.

Pipers also recently launched two new crisp flavours that can help wholesalers meet demand for vegan snacks: Wild Thyme & Rosemary and Jalapeno & Dill.

Protein power

While a combination of health consciousness and environmental concern has accelerated demand for vegan products, some of the same trends are boosting sales of meat snacks. In particular, the increased popularity of gyms and working out has created a booming market in protein snacking.

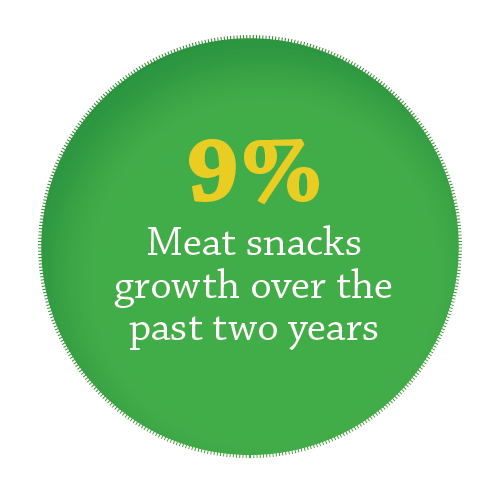

“As a result, meat snacks growth has flourished due to its credentials as a protein source, growing by 9% over the past two years,” says Pavan Chandra, marketing manager for Peperami.

Alongside Peperami’s well-established Beef and Pork snack bars, wholesalers can consider Jack Link’s range of Beef Jerky products. Jack Link’s Biltong, launched last year, contains less than 80 calories per snack, and combines high-protein with low-fat.

But what balance of these products to stock – vegan innovations versus protein-packed meat snacks – will vary for each wholesaler.

Are the customers serving hip millennials concerned about the causes of global warming? Or are they targeting fitness fiends dedicated to sculpting their bodies in the many gyms that dot the local area?

Adventures in taste

If health is the number-one priority driving trends in snacking, then a desire for adventurous and exciting experiences is undoubtedly number two. “The booming demand for bolder, spicier flavours is being driven by ever more adventurous consumers seeking out new and authentic taste combinations,” says Eat Real’s Wheeldon.

If health is the number-one priority driving trends in snacking, then a desire for adventurous and exciting experiences is undoubtedly number two. “The booming demand for bolder, spicier flavours is being driven by ever more adventurous consumers seeking out new and authentic taste combinations,” says Eat Real’s Wheeldon.

It’s a trend that’s been noted in convenience stores, too. “It’s all about flavour rather than health in my store,” says Natalie Lightfoot, owner of a Londis in Glasgow. “We’ve just introduced Tayto crisps, a Northern Irish brand, which goes down well in this part of Scotland where there’s a big Celtic community.”

As a result, product innovation is taking place at a rapid rate. Walkers is launching two new flavours based on street food classics from opposite sides of the globe in BBQ Pulled Pork

and Spicy Sriracha.

Eat Real’s Cofresh range continues to benefit from trends towards unusual flavours. Its popular potato-based Grills range – containing 30% less fat – comes in six varieties, including Sweet Chilli, Peri Peri and Chilli & Lemon. Meanwhile, Pladis’s Jacob’s Ciabatta Crackers brand is now worth £3m.

It’s joined in the Jacob’s range by Flipz pretzels: crunchy, savoury pretzels covered in chocolate.

Hot snacking on the go

Another trend impacting the UK’s convenience stores is food to go, as time-pressed consumers look to grab something quick and tasty as they rush through their day. Combined with shifting habits whereby eating little and often is displacing the traditional three full meals a day, this opens new opportunities for the snacking category.

Such trends have boosted sales of hot snacks such as Symington’s Naked range, with preparation times clocking in under five minutes across the board. Naked Noodle, Naked Rice and Naked Soup are available in a range of flavours that also dovetail with trends towards foreign flavours, such as Katsu Curry and Char Siu.

Alternatively, the firm’s Mug Shot range is currently the number-one hot snack among female consumers, with limited-edition varieties such as Firecracker Chicken Noodles and Texan Sticky Rib Noodles set to drive sales growth throughout 2019.

Retailer viewpoints

“We’ve noticed a big change from people buying smaller packets to buying bigger bags. I recently upped my range of £1 sharing bags and they’re flying out. Walkers are the most popular brand, but people buy a lot of own-brand, too: we’ve got Happy Shopper sharing bags at two for £1 and they go very well.”

“People’s eating habits are changing: instead of eating three big meals a day, they’re increasingly relying on small snacks consumed throughout the day to keep them going. But they also want those snacks to be healthy. We’ve cut down our grocery to make space for a dedicated section of healthier snacks.”

“We prioritise having a wide range of products and we’ll try anything new that comes out. Walkers Direct and Bestway both visit us every two weeks and tell us about new product launches. Customers comment on our offering: we’ve got a Sainsbury’s and WHSmith nearby, and they’ll say they can’t find some lines anywhere else.”

“People are generally looking for value, so we are sizing up to value bags of crisps. However, there is also some movement towards healthier products – we’ve just put out the new Rice Fusions Pringles and they’re selling well. They’re price-marked at £1, which is a popular price in the crisps category.”

Supplier viewpoint

Trading director,

KP Snacks

“Wholesalers need to stock a strong core that covers the bestselling lines to deliver category growth. This is evident in the fact that 60% of sales go through the top 50 bestsellers.

“Blocking similar products together, such as ridged crisps, will make it easier for your customers to find what they need and depots should use events to drive sales such as sporting or seasonal occasions as well as the big night in.

“Wholesalers also need to embrace price-marking because £1 PMP ranges are growing at more than 15%, while non-price-marked formats are experiencing nearly a 3% decline.”

Product news

Combining high protein with low fat and an exciting South African flavour profile, it’s no surprise that Jack Link’s Original Biltong has become an immediate bestseller since its launch.

Springing off demand for bold flavours that evoke exciting destinations, KP Snacks’s Mexico-inspired Muchos Smoky Chilli Chicken is a must-stock NPD for this year.

Springing off demand for bold flavours that evoke exciting destinations, KP Snacks’s Mexico-inspired Muchos Smoky Chilli Chicken is a must-stock NPD for this year.

Responding to demand for flavour-packed food to go, Symington’s continues to expand its range of instant hot snacks with Naked Noodle Sweet Chilli. They are said to be a good source of protein.

Gluten-free since its launch in 1987, KP Snacks’s classic Pom Bears Original is experiencing a rise in sales thanks to the explosion in demand for free-from snacks.

Mug Shot is the number-one hot snacking brand among female consumers, making Mug Shot Heart Warming Roast Chicken Pasta a top-seller in UK convenience stores.

The traditional British favourite Original Peperami is capitalising on demand for protein snacks to win over a new generation of consumers – gluten-free and high in protein.

A salty savoury core covered with dark chocolate: Pladis’s Flipz Dark Chocolate Pretzels has gained a strong following among consumers seeking sweet and savoury flavour combinations.

Pladis’s new Go Ahead Nutty Crunch Hazelnut is packed with protein, contains less than 100 calories and is targeting consumers hunting for healthier snacks.