With the festive season fast approaching, Tom Gockelen-Kozlowski speaks to key suppliers to find out what Christmas confectionery wholesalers should be stocking this year

Christmas is a confusing and expensive time for shoppers, but that doesn’t mean that a bonanza is guaranteed for businesses that serve them. In a key category such as confectionery, it is vital that retailers are able to stock the right products, offer the right prices and have them on shelf at the most appropriate time. If they can do this, it is a multimillion-pound opportunity the channel can’t afford to miss.

“The seasonal opportunity is evolving year on year, and what we see is that shoppers are looking to independent retailers for seasonal items and have a real appetite for premium and gifting products. Wholesalers need to make it really easy for stores as they are a trusted point of information,” says Jodie Wood, head of wholesale at Ferrero.

Fortunately, with the aid of innovative NPD and a little category management advice, suppliers and wholesalers can work together to create an offer for retailers that makes the depot a key destination for chocolate from the first impulse treat to the last-minute gift.

Susan Nash, trade communications manager at Mondelez, says: “Chocolate is the most frequently consumed and gifted category at Christmas, so it’s essential that depots prepare their range early to help retailers maximise their shoppers’ seasonal spend. The opportunity for seasonal sales begins in September and lasts until the end of December, with three-quarters of consumers agreeing confectionery is central to their festive traditions.”

Susan Nash, trade communications manager at Mondelez, says: “Chocolate is the most frequently consumed and gifted category at Christmas, so it’s essential that depots prepare their range early to help retailers maximise their shoppers’ seasonal spend. The opportunity for seasonal sales begins in September and lasts until the end of December, with three-quarters of consumers agreeing confectionery is central to their festive traditions.”

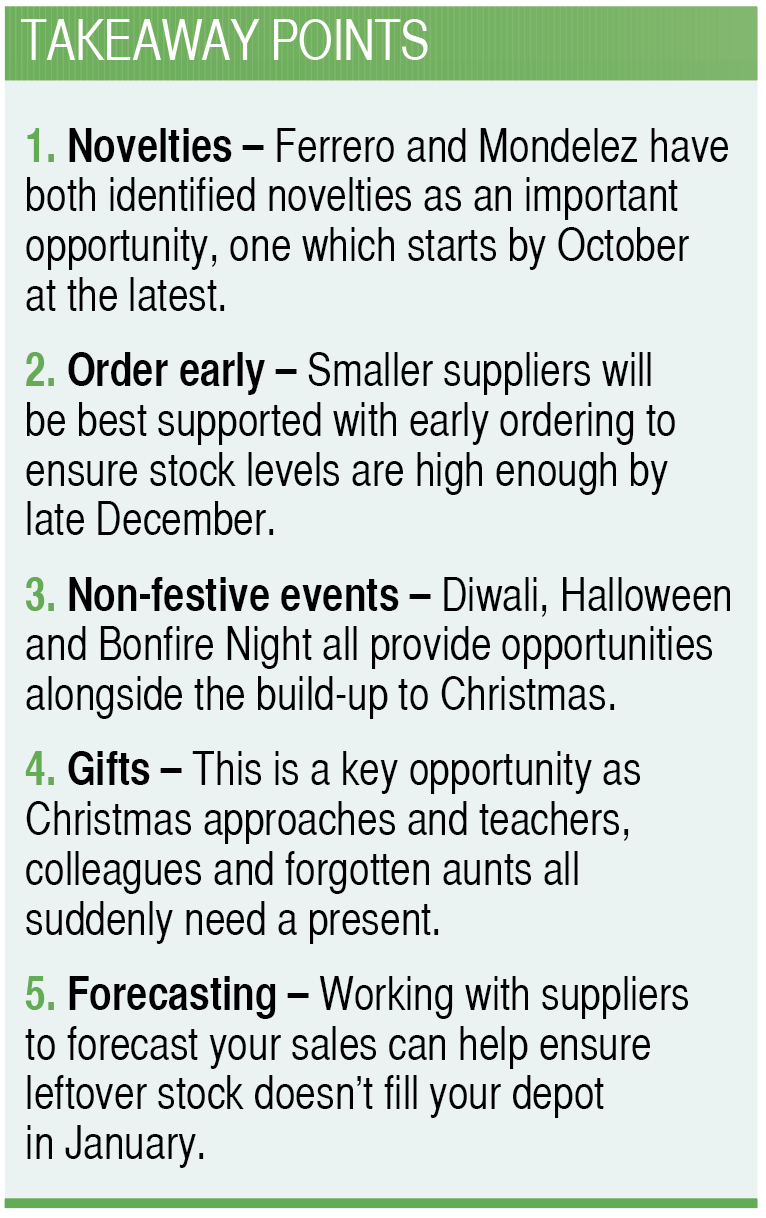

For this reason, much of the advice from Mondelez regards understanding the key times running up to the season. Nash advises retailers to have products available as early as September as there is a growing trend among shoppers to spread the cost of the festive season by buying early.

- Read more: Improve your chocolate bars & sharing range

The next stage identified comes in October, when stores should introduce novelties. In general, this is a period when Mondelez says stores and depots should both be making more space for Christmas.

It is unsurprisingly during November and December when the Christmas chocolate market explodes, and one of the key products that defines November is gifts.

Nash says: “Wholesalers should enable retailers to ramp up their Christmas confectionery offering for the final push with eye-catching displays and dedicated space in store for seasonal lines. Large sharing packs and gifts, such as tubes, tubs, selection boxes and kids gifting ranges, are key during December and offer a significant opportunity for trading up, as consumers look for special gifts for friends, family, work colleagues and teachers.”

Other dates will have an effect and are worth planning for in the context of Christmas, too. Firstly, Halloween is a huge confectionery sales opportunity and this will need to be reflected in a depot’s range and promotional space.

Diwali and Eid

Major suppliers are also increasingly switching on to the sales opportunity presented by non-Christian faiths. For the second year running, Ferrero is providing retailers who use yourperfectstore.co.uk, with Diwali kits for the season.

“We’ve placed a lot of focus on religious festivals – such as Diwali and Eid – for a number of years now,” says Levi Boorer, customer development director at Ferrero.

“We invested in extensive research with 1,000 convenience operators back in 2016, which revealed that 71% of retailers at the time weren’t actively engaging around the occasion with their customers. There’s been a real shift since then.”

While retailers were wary of stocking advent calendars – which can be heavily discounted by supermarkets – many stores now consider them a must-stock. “We’re seeing more sales from advent calendars, which are often an impulse or distress purchase in the independent channel,” says Wood at Ferrero.

Changing behaviour

Yet changing consumer behaviour, wider trends and the exciting nature of the festive season means ranges can’t stay cemented from year to year and knowing where the market is headed is as key to success as any category management strategy.

Other trends, such as the rising number of vegans in the UK, are also having an effect on the market – and it provides an opening for smaller producers to step in to fill the gap. Moo Free Chocolates is one such company and has produced a chocolate orange snowman for this year’s festive season.

It’s worth being clear, however, that because customers are looking for a product that meets their ethical or dietary requirements, it doesn’t mean sacrificing taste or indulgence.

“Chocolate has never been and never will be a health product,” says Leah Clifford, customer services director at Moo Free Chocolates.

She agrees that a major challenge is timings – production, deadlines on catalogues and forecasting – and suggests the sooner depots reach out to smaller producers, the sooner they can guarantee delivery for any festive orders.

And then there are those looking for an alternative to chocolate. Sugar confectionery manufacturers with much-loved brands are similarly adapting their portfolios to the festive season. Swizzels, the brand owner of Drumsticks and Love Hearts, is a case in point.

Mark Walker, sales director at the firm, says: “Christmas is one of the biggest calendar events for sugar confectionery and Swizzels has experienced significant sales growth during Christmas time over the past three years, achieving 13% sales growth in 2018.”

Retailer viewpoints on Christmas confectionery

“I haven’t started my orders just yet, but what we do increasingly is focus on where we can get the good margins, and that means stocking more premium items. We concentrate on premium items and use a couple of local wholesalers for this. This year I will be looking out for more vegan products, too.”

“I’d like to see wholesalers bring in a bargain range of non-branded Christmas products that offers some-thing quirky at a lower price. We have a Hancocks in Dundee and it’s only 45 minutes away, but as someone who is in their business seven days a week, that can be too much time to take out.”

“This year, we are going to focus on a ‘less is more’ approach, I think some products can get a bit lost at Christmas. Last year, Thorntons large boxes at £10 performed well and I think customers associate Thorntons with something more premium. We’re looking to make 20% profit minimum, and would be happy with 25%.”

“When it comes to Christmas, we don’t sell much that’s different than usual. We might get in some boxes of chocolates such as Maltesers for people to pick up for a teacher. I don’t think there’s a massive market, though, and Booker and Hancocks cater for what we need.”

Sales forecasts

If you are putting together a core range for your retail customers, it is these big brands that suppliers say anchor the category and need to be visible. Others agree with the importance of big names: “Independent retailers look for inspiration from mainstream brands they recognise,” Wood says.

One concern that has been long-standing for both independent retailers and wholesalers is that stocking up on Christmas-themed stock can provide the risk that – after 25 December – huge amounts of stock can be left behind, which is either discounted or wasted.

Jodie Wood, however, believes the increasingly sophisticated use of data by both wholesalers and suppliers means this risk is getting ever lower.

“Suppliers have a lot of data to make it as straightforward as possible. And a lot of wholesalers share their data, which helps us build up a picture of their sales as accurately as possible,” she adds.

With manufacturers able to help build a sales forecast for your depot, whole-sale staff can concentrate on helping customers have the most profitable

and effective Christmas period possible in 2019.

It’s time to dust off the tinsel and start sharing the learnings.

Supplier viewpoint

“We talk a lot about shopper missions, but I also think it’s important to think about retailer missions and look at the opportunity for depots from a cross-category perspective. Think about the products that are commonly bought together for gifts – not just confectionery, but also cards, wine and spirits. This can be in depot and also in brochures and online. We find that retailers also want to stock larger sizes of boxed chocolates during this time, so it might be worth looking at stocking bigger formats of brands such as Thorntons, which customers associate with the festive season.”

Christmas confectionery product news