Recent developments have led to unpredictable changes in the wines and spirits category, forcing wholesalers to adapt quickly. Katherine Brook takes a deep dive to find out the latest alcohol trends, challenges and NPDs

The trends in the alcohol category move fast at the best of times, with launches regularly hitting the market in response to changing consumer habits. But over the past couple of months, the industry has experienced a set of unique occurrences, with wholesalers having to re-evaluate their offering in depot.

Across the category, the main trend the industry is seeing is the at-home occasion, as the impulse channel becomes pivotal in propping up the off-trade in the current climate.

According to Gemma Cooper, senior commercial business partner at Nielsen, recent shopper research has shown that many UK shoppers are choosing to shop locally during the coronavirus pandemic, with wine, rum, gin and beer being popular choices.

And as the social distancing restrictions and pub closures look to continue into the warmer months, this is a trend that it is widely believed will remain.

“Wholesalers should be aware that with pubs and bars closed, many consumers will want to replicate the same premium experience they enjoy when they go out, at home,” says Nick Williamson, marketing director at Campari UK.

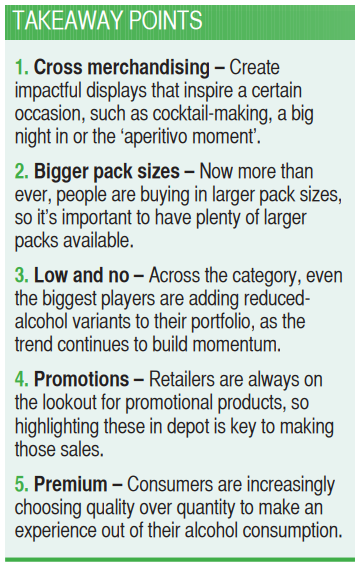

“Eye-catching cocktails that don’t require you to be an expert mixologist are key to this. There’s a clear opportunity for wholesalers to help retailers increase sales and footfall, by guiding them to stock the ingredients for the easy-to-make classics.”

To do this, Williamson recommends displaying ingredients together, such as mixers alongside spirits, and garnishes, too, as this will encourage multibuy purchases, significantly boosting the average basket spend.

Thirst for new flavours

While the launch of NPD may be slightly delayed this year, the desire for premium and flavoured spirits will not go unnoticed. Last year, malts were up 3.6% and rum grew by 4.1%, with the biggest sales increase fuelled by gin, which grew by 52.2% in value, according to CGA. Meeting this demand – and hitting the market just in time – is Gordon’s

Sicillian Lemon Distilled Gin, which the brand expects to be a common choice over the warmer months.

Hannah Dawson, head of off-trade category development at Diageo GB, expects rum to remain popular, too. “Consumers continue to experience and try different taste combinations, like new Captain Morgan Tiki, a tropical rum flavoured with pineapple, which launched in March this year,” she says.

There’s also been a rise in the ‘aperitivo moment’ – a traditional Italian pre-dinner drink often enjoyed with light snacks. Whether this is a classic Negroni, Aperol Spritz or a simple glass of wine or beer, ensuring a selection of snacks is available to enjoy alongside a drink is definitely an area wholesalers can make the most of.

For example, wholesalers could advise their customers to place the ingredients for an Aperol Spritz next to typical aperitivo food, such as cold meats, cheese and olives, which Williamson says will help retailers increase cross-category spend.

He adds: “With international travel on pause, this approach to merch-andising will help create their feel-good ‘holiday’ moments.”

While there is a clear increase in the demand for alcohol at the moment, be it spirits or wine, wholesalers should also be mindful of how people are buying it.

In addition to spending more time at home, consumers are also making a conscious effort to visit stores less frequently and are therefore buying alcohol and accompanying snacks in larger pack sizes and quantities.

To make sure retailers are equipped with enough stock to fulfil their customers’ needs, wholesalers should keep a strong selection of larger pack sizes available, specifically those brands holding promotions.

Wine

It may feel like spirits are getting all the limelight, but wine is just as much in demand. According to the Covid-19 Impact Report by Wine Intelligence, the UK’s 28 million wine consumers have been drinking more wine at home, and more frequently now than before lockdown measures were imposed.

While this was expected with people spending more time at home, the report shows that this increase is greatly down to the growing number of ‘wine-drinking moments’.

Co-founder and chief executive of Wine Intelligence Lulie Halstead says: “As well as the usual with-food occasions, wine has become part of many of the new non-food occasions, for instance catching up with friends online or pre-dinner drinks that start earlier in the day than ever before.”

With this in mind, wholesalers should be looking to stock wine in formats, to cater for the differing occasions, including bottled wine and cartons, as well as canned.

“Canned wines are on the rise in the UK, with value sales up 132%,” says Ben Blake, head of marketing in Europe at Treasury Wine Estates.

In addition to this, on-the-go formats and sparkling drinks are becoming synonymous with social occasions – even virtual ones. In response to this, Treasury Wine Estates recently launched its Blossom Hill Gin Fizz sub-brand in a RTD can format, which Blake says will help it reach new consumers.

Low and no

While the number of those drinking low- and no-alcohol beverages doesn’t yet come close to that of more traditional alcohol options, it’s a portion of the market that wholesalers shouldn’t overlook.

According to Blake, there is huge potential within the retail sector to maximise sales opportunities – it’s only a matter of time.

From zero-ABV spirits such as Seedlip and Cedars to low-ABV sparkling wines, sales are showing no sign of slowing down, so it’s imperative that wholesalers have a strong selection in their depots.

“Offering customers a broad, diverse range of low- and no-alcohol products ensures demand is being met, while maintaining supply of familiar brands,” says Blake. “Thoughtful planning in depot is essential in the low- and no-alcohol sector to ensure retailers can respond to changes in consumer trends.”

And it isn’t just the big brands looking for a cut of the market. New low-alcohol producers are regularly appearing, including at the recently established Hensol Castle Distillery in South Wales with the launch of Trulo. One of the distillery’s first products, the new low-calorie, low-sugar and low-alcohol liquor has been created to meet the number of consumers who are now making more health-conscious decisions when it comes to drinking alcohol.

Whether it’s wine or spirits, multi-packs or singles, if done correctly, it is a category primed for wholesalers to take advantage of in the coming months.