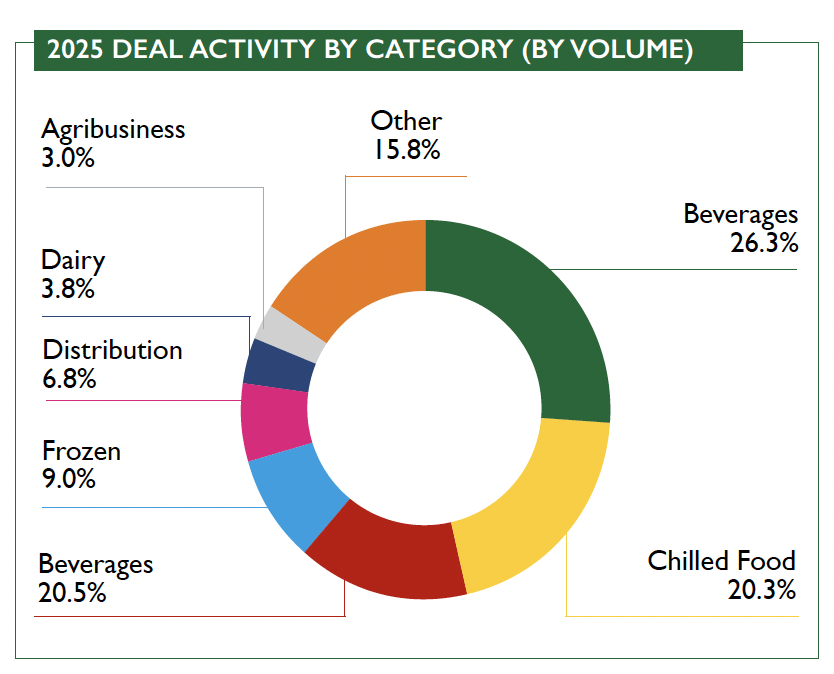

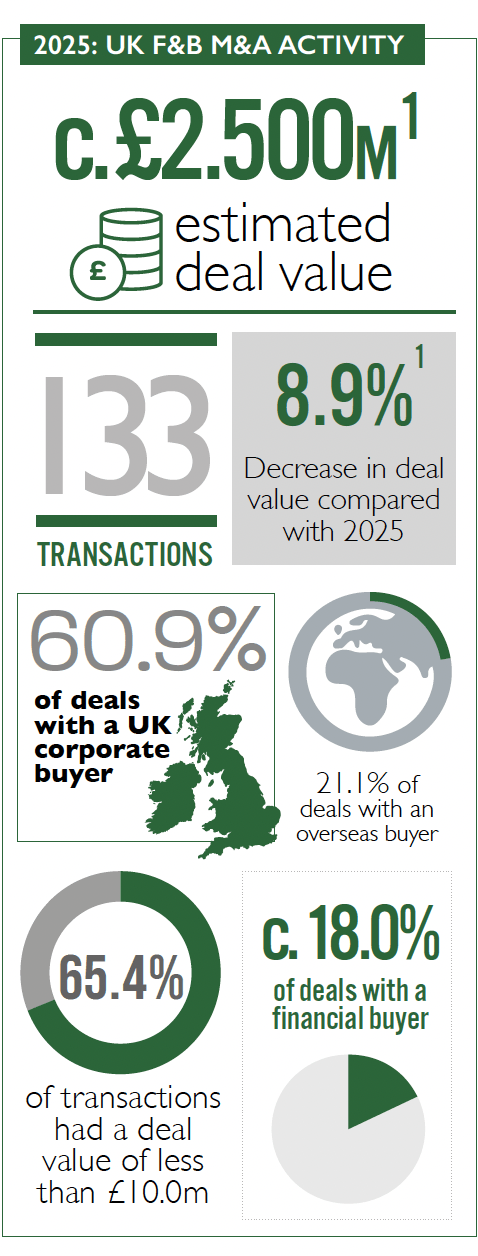

133 M&A transactions were concluded in the food and drink industry over the course of 2025, a 12% drop on the previous year (-9% in aggregate value).

In a report from Oghma Partners, the company’s highlights Sysco’s acquisition of Fairfax for £54m as one of numerous consolidations. The findings also predicts more subsector consolidation, strategic M&A, cautious consumer spending, as well as geopolitical risks in 2026.

Read more: Sysco continues fresh meat growth strategy with Fairfax acquisition

Mark Lynch, partner at Oghma Partners, said: “2025 has once again been characterised by geopolitical

uncertainty, yet M&A activity in the UK has remained resilient, supported by the gradual reco

very of the economy. Since August 2024, the Bank of England has implemented six interest rate cuts, bringing the base rate to 3.75%. Inflation has held relatively steady between 3.0% and 4.0% throughout the year, with the latest CPI reading at 3.4% in December. Food and non-alcoholic beverage inflation has been more volatile, peaking at peaking at 5.1% in July before falling to 4.5% in December.

“Governor Andrew Bailey has indicated that rates are ‘likely to continue on a gradual downward path’. Nevertheless, global tensions, including conflicts in Europe and the Middle East, recent developments in South America, and emerging US tariffs, continue to add complexity and uncertainty for the UK market,” he added.