Paul Hill looks at how international trade can be a new avenue for wholesalers to differentiate their businesses

With inflation still squeezing margins and consumer behaviour evolving rapidly, many wholesalers are discovering that the best way to grow is to look beyond the UK.

The import and export of food-and-drink products has been brought to the public’s attention recently with President Trump’s tariff proposals. Once a niche or reactive part of the business, imports and exports is starting to become more of a vital pillar for certain wholesalers as they look to differentiate themselves in an ever-challenging market.

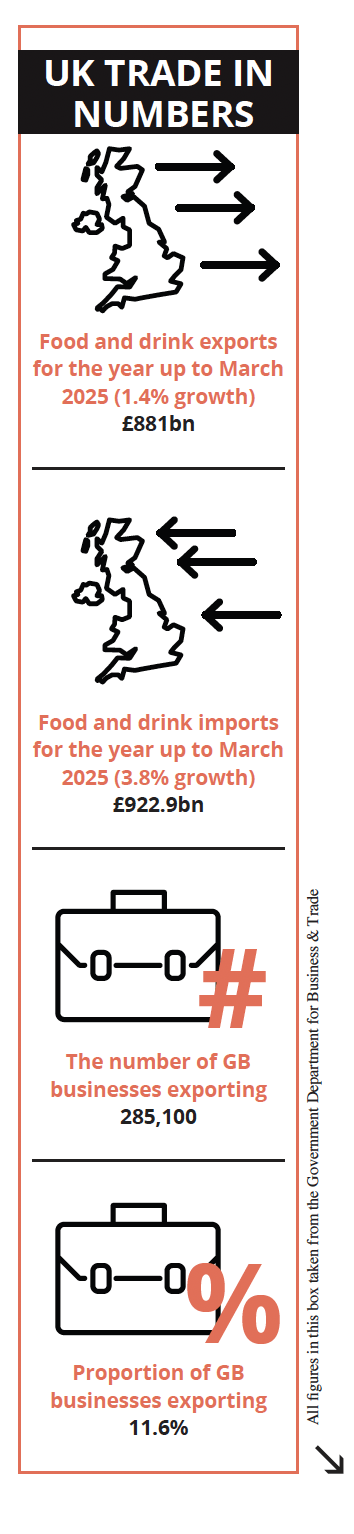

According to the UK’s Department for Business and Trade, food-and-drink exports were valued at £1,803bn in 2024, a 2.6% increase year on year, with imports into the UK worth £922.9bn.

These figures highlight a growing opportunity and a need for strategic positioning.

From exporting British brands to the Middle East, to introducing premium European fresh produce into UK foodservice, wholesalers can become logistics-savvy, compliance-conscious global operators.

But how can they make the leap from local to international – and what are the challenges, risks and real rewards?

“Diversifying into export was a game-changer for us,” says Debbie Harrison, joint managing director of Sheffield-based wholesaler Pricecheck, whose business now trades in more than 100 countries.

The company found that what may be standard in the UK can be premium overseas.

Pricecheck’s export division now contributes more than a third of the company’s revenue, and has seen consistent annual growth. The business is proof that UK wholesalers can thrive abroad with the right strategy and structure in place.

Research

At the heart of Pricecheck’s international growth is a mix of local market understanding, cultural sensitivity and regulatory preparation, with the compliance team ensuring correct labelling, customs documentation and product certifications are in place for each market.

Harrison adds: “Research is key. While visiting the territory may seem obvious, it’s the best way to understand the markets.

“Consider target demographics, competitors and market trends, as well as whether it works alongside local regulations and cultural preferences.”

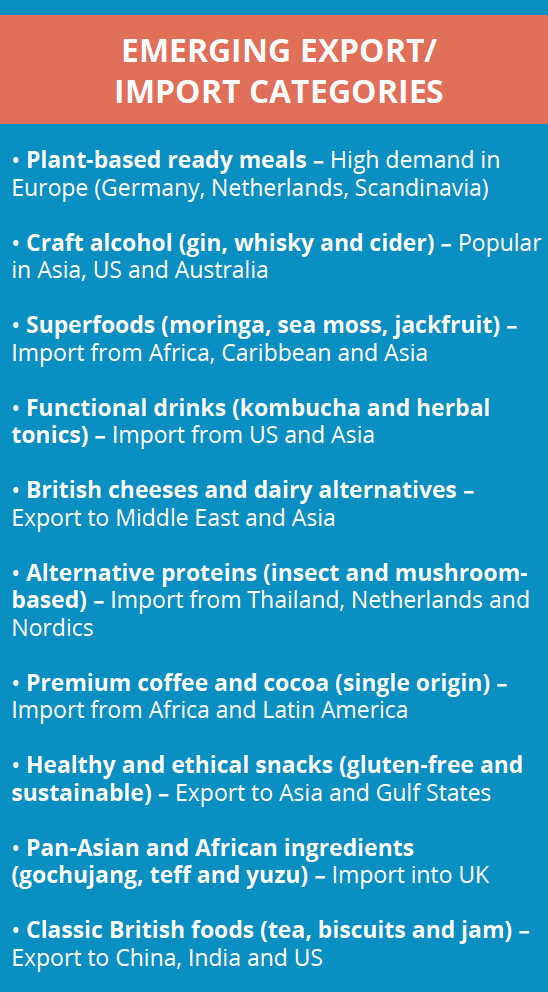

For many UK wholesalers, exports begin with food and drink brands that have strong heritage appeal. Biscuits, confectionery, sauces and even health-and-beauty products with UK provenance are in demand across Asia, Africa and the Middle East.

Crucially, it’s not just about big-volume players. Mid-sized wholesalers are also developing bespoke export arms, working with UK brands to serve diaspora markets or niche international retailers looking for UK innovation.

While the export opportunity is large, imports are just as vital— particularly in driving product innovation and satisfying demand from UK foodservice operators and retailers for fresh, sustainable and premium international lines.

One area of growth is fresh produce. UK wholesalers increasingly partner with international suppliers that offer year-round availability, high environmental standards and logistical reliability.

Wholesalers are even going as far as Australia for products, with government agencies such as Austrade acting as a bridge between suppliers and international clients, many of which fall into the wholesale category.

Austrade not only represents Aussie products from a promotional standpoint, but also acts a business facilitator.

Logistics

Modern wholesalers must master not just the sourcing, but the speed. Whether it’s Pricecheck working in the Netherlands, or Belgian wholeslaler Calsa delivering to London within 16 hours, turnaround time is increasingly a competitive advantage.

Wholesalers are investing in digital inventory manage

ment, customs tech platforms and bonded warehousing to support fast, compliant trade.

Green logistics is also gaining traction, with importers and exporters alike looking to offset carbon footprints, reduce packaging waste and improve loading efficiency.

“We invested in 576 solar panels and reuse heat from our refrigeration,” says Jeroen Buyck, chief executive of Calsa. “Sustainability isn’t just ethical – it’s what our customers expect.”

In 2025 and beyond, global thinking is no longer optional for wholesalers – it’s imperative. For those willing to invest in compliance, partnerships and strategic market exploration, international trade is a powerful growth engine.

Whether you’re importing tomatoes from Belgium, exporting Cornish sea salt to Qatar or launching a private-label range in Poland, the tools, technology and demand are all there.

Expanding internationally is not just about revenue, it’s also about relevance. As UK consumers diversify their tastes and global markets look to British heritage and innovation, wholesalers that move early can establish long-lasting trade routes.

As the UK foodservice and convenience wholesale sector grapples with inflation, supply chain disruptions and evolving consumer tastes, one opportunity is standing out: looking beyond domestic borders. Importing innovative global products and exporting British specialities.